- 20 Marks

FM – Nov 2022 – L3 – Q3 – Financing Decisions and Capital Markets

Evaluate the financing structure and calculate required return, WACC, and factors influencing beta.

Question

Zakai (ZK) Plc is a listed company that owns and operates a large number of farms throughout the country. A variety of crops are grown.

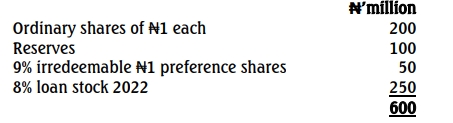

Financing Structure:

The following is an extract from the statement of financial position of ZK Plc as at 30 September 2021:

The ordinary shares were quoted at ₦3 per share ex div on 30 September 2021. The beta of ZK Plc’s equity shares is 0.8; the annual yield on treasury bills is 5%, and financial markets expect an average annual return of 15% on the market index.

The market price per preference share was ₦0.90 ex div on 30 September 2021. Loan stock interest is paid annually in arrears and is allowable for tax at 30%. The loan stock was priced at ₦100.57 ex interest per ₦100 nominal on 30 September 2021. Loan stock is redeemable on 30 September 2022.

Assume that taxation is payable at the end of the year in which taxable profits arise.

A New Project:

Difficult trading conditions have caused ZK Plc to decide to convert a number of its farms into camping sites with effect from the 2022 holiday season. Providing the necessary facilities for campers will require major investment, and this will be financed by a new issue of loan stock. The returns on the new campsite business are likely to have a very low correlation with those of the existing farming business.

Required:

a. Using the capital asset pricing model, calculate the required rate of return on equity of ZK Plc as at 30 September 2021. Ignore any impact from the new campsite project. (3 Marks)

b. Briefly explain the implications of a beta of less than 1, such as that for ZK Plc. (2 Marks)

c. Calculate the weighted average cost of capital (WACC) of ZK Plc as at 30 September 2021 (use your calculation in answer to requirement (a) above for the cost of equity). Ignore any impact from the new campsite project. (10 Marks)

d. Without further calculations, identify and explain the factors that may change ZK Plc’s equity beta during the year ending 30 September 2022. (5 Marks)

(Total 20 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Beta Analysis, CAPM, Cost of Capital, Equity Valuation, Financing Structure, Investment decisions

- Level: Level 3

- Topic: Financing Decisions and Capital Markets

- Series: NOV 2022