- 20 Marks

FM – Nov 2021 – L3 – Q2 – Mergers and Acquisitions

Advise on financial synergies from KP's acquisition of TE and evaluate cash vs. share-for-share offers.

Question

You run a financial consultancy firm and have been approached by a new client for advice on a potential acquisition. Kola Plc (KP) is a large engineering company that was listed on the stock market ten years ago, with the founders retaining a 20% stake in the business. KP initially experienced rapid growth in earnings before tax, but soon after listing, competition intensified, leading to a significant decline in growth, which currently stands at 4%. Concerned about limited future growth opportunities, the board has decided to adopt a market development strategy for growth by acquiring companies in less competitive regions using KP’s significant cash reserves. The board has identified Temidayo Engineering (TE) as a potential acquisition target.

Temidayo Engineering (TE):

TE is a private engineering company established eight years ago, with early accumulated losses that have now turned profitable, achieving an 8% annual growth in earnings before tax. Cash reserves remain low, and capital access has been a constraint on TE’s investment potential. The founders and their families own 70% of the shares, while a venture capitalist holds the remaining 30%.

Acquisition Information:

KP’s board prefers that TE’s founders remain as directors post-acquisition and has sufficient cash reserves to purchase TE outright. A cash offer of ₦13.10 per share is considered likely to encourage TE’s shareholders to approve the acquisition. Alternatively, KP’s board is exploring a share-for-share exchange to preserve cash for future acquisitions and dividends. Recent mergers in the industry have attracted a 25-30% acquisition premium, with TE’s shareholders expecting a premium towards the higher end for a share-for-share offer. KP has asked you to design a share-for-share offer scheme with a 30% premium.

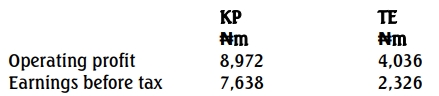

Extracts from the Latest Financial Statements:

Additional Financial Information:

- KP has ₦0.50 ordinary shares totaling ₦7,500 million, with each share trading at ₦5.28. It is expected that KP’s price-to-earnings (P/E) ratio will increase by 10% if the acquisition proceeds.

- TE upgraded its main manufacturing facility last year, expecting annual pre-tax cost savings of ₦50 million from the current financial year. TE has ₦0.25 ordinary shares totaling ₦700 million. TE’s P/E ratio is estimated to be 20% higher than KP’s current P/E ratio based on comparable company analysis.

- KP’s CEO estimates annual pre-tax revenue and cost synergies of ₦304 million post-acquisition, while the finance director anticipates additional pre-tax financial synergies of ₦106 million, though cautiously, following reports that many acquisitions overestimate synergies. The tax rate is 20%.

Required:

a. Discuss possible sources of financial synergy arising from KP’s acquisition of TE. (6 Marks)

b. Advise the directors on a suitable share-for-share exchange offer that meets TE’s shareholders’ criteria and calculate the impact of both cash and share-for-share offers on the post-acquisition wealth of KP’s and TE’s shareholders. (14 Marks)

Find Related Questions by Tags, levels, etc.