- 15 Marks

AT – Nov 2022 – L3 – Q7 -Taxation and Corporate Governance

Calculate the tax liabilities and deferred tax provisions for ICTREC Mining Company Limited, ensuring compliance with Nigerian tax law and addressing FIRS requirements for accurate financial reporting. The report will guide the company in meeting its tax obligations and preparing financial statements free of queries.

Question

The Managing Director of ICTREC Mining Company Limited is concerned about the correct computation and presentation of deferred taxes in the company’s financial statements. Last year, the Federal Inland Revenue Service raised a query on the company’s financial statements and the annual tax returns filed for tax assessment purposes.

To avoid any future tax queries on the financial statements, the Managing Director has approached your firm of chartered accountants to assist in preparing financial statements suitable for presentation at the company’s annual general meeting and submission to the tax authorities for determining tax liabilities.

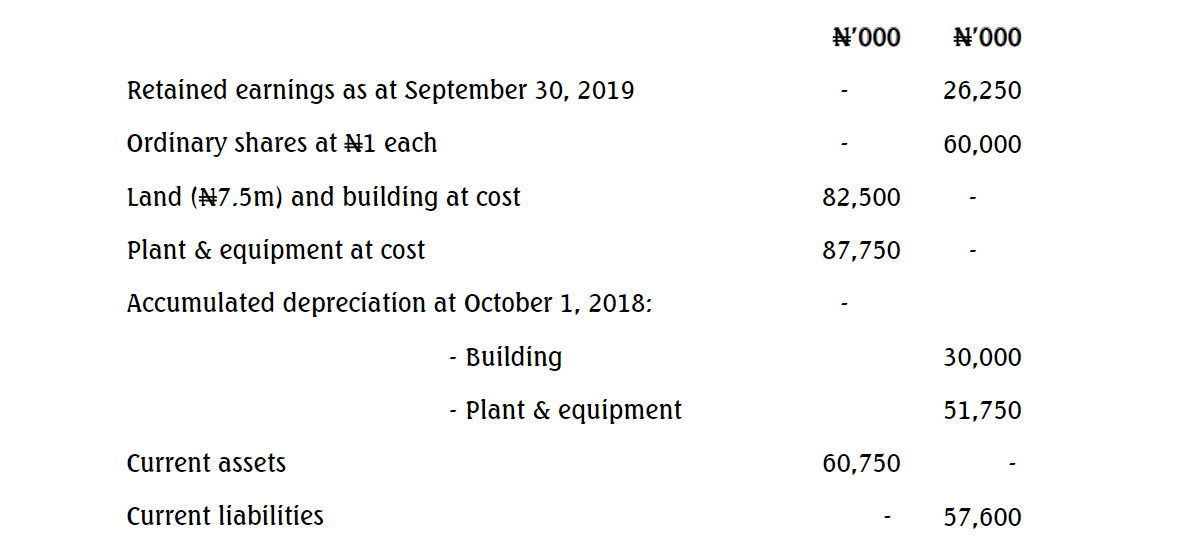

All relevant books of accounts for ICTREC Mining Company Limited’s financial transactions have been made available to you. The following is an extract from the accounts for the year ended December 31, 2021:

Income and Expenses (N’000):

- Turnover: 125,400

- Rent and Rates: 12,200

- Direct Mining Transportation Cost: 1,190

- Direct Mining Cost: 47,400

- Gross Profit: 64,610

- Dividends Income (net): 3,900

- Interest on Foreign Deposit: 2,750

- Total: 71,260

- Salaries and Wages: 25,340

- Depreciation of Mining Plant: 2,500

- Depreciation (Other Non-Current Assets): 7,840

- Other Administrative and General Expenses: 4,210

- Loan Interest: 850

- Loss on Sale of Old Mining Plant: 200

- Net Profit: 30,320

Additional Information:

- Interest on foreign deposit was repatriated through the company’s domiciliary account in a Nigerian deposit money bank.

- Unrelieved losses amount to N2,800,000.

- Capital allowance agreed with tax authorities for the year was N7,250,000.

- Tax written down value of qualifying capital expenditure as of December 31, 2021, was N35,110,000, while net book value was N23,700,000.

- Opening tax written down values and net book values were N42,620,000 and N33,900,000, respectively.

- Unpaid tax at the beginning of the year was N15,620,000, with payments made during the year totaling N18,860,000.

- Depreciation rate of 10% per annum applies to the mining plant.

- The mining plant was revalued in 2017, with a revaluation surplus of N5 million included in the financial statements that year.

Required:

You have been directed by your Principal Partner to work on this assignment and prepare a draft report for his review. The report should show the computation of the following:

- Tax liabilities for the relevant year of assessment

(7 Marks) - Deferred tax provisions for 2021 and 2022

(8 Marks)

Total: 15 Marks

Find Related Questions by Tags, levels, etc.