- 10 Marks

FA – Nov 2024 – L1 – Q5a – Inventory Loss and Statement of Profit or Loss

Compute inventory loss due to fire and prepare a statement of profit or loss for a sole trader.

Question

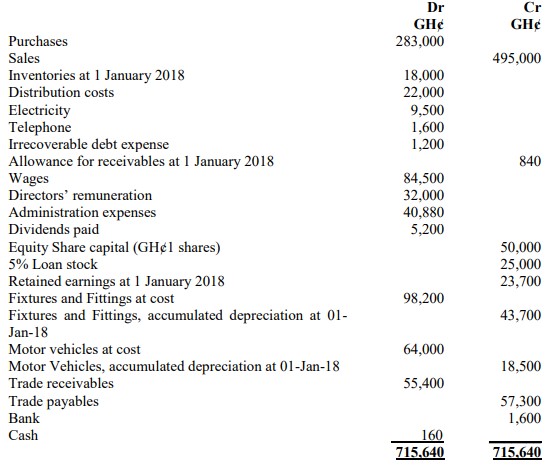

Mawulolo Enterprise is a retail business that prepares its accounts on 31 March each year. The business maintains a standard gross profit margin of 30% on sales.

The following financial information was extracted from its records as at 31 March 2024:

| Item | GH¢ |

|---|---|

| Inventory at 1 April 2023 | 254,000 |

| Operating Expenses | 378,000 |

| Finance Cost | 58,000 |

| Purchases | 1,306,000 |

| Sales | 1,900,000 |

| Inventory in good standing at 31 March 2024 | 192,000 |

On 31 March 2024, a fire outbreak in the warehouse destroyed some of the inventory records and goods.

The tax charge for the year is estimated at GH¢30,000.

Required:

i)Calculate the amount of inventory lost.

ii) Prepare the Statement of Profit or Loss for the year ended 31 March 2024

Find Related Questions by Tags, levels, etc.

- Tags: Cost of Sales, Financial Adjustments, Fire Loss, Gross Profit, Inventory Valuation, Net Profit

- Level: Level 1