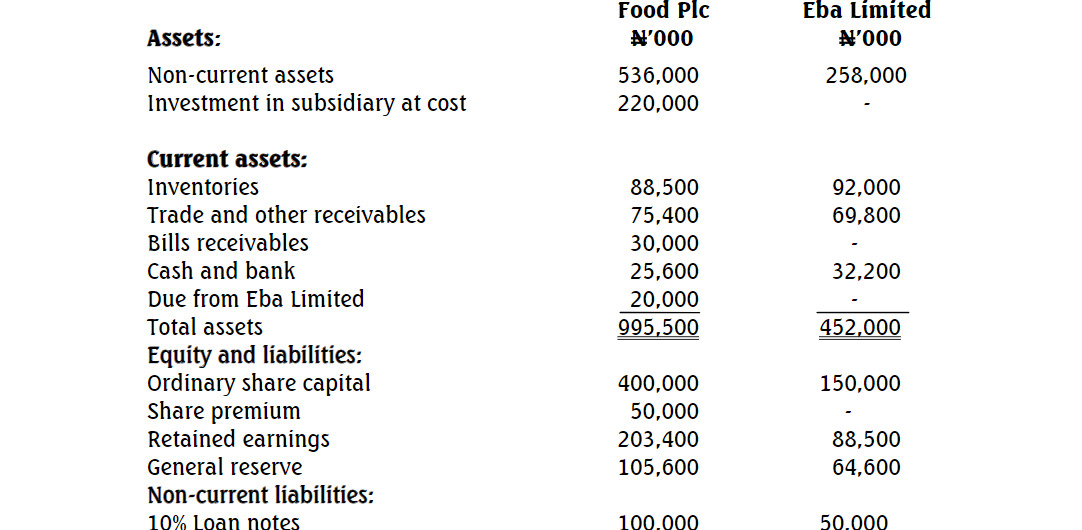

The following statement of financial position relates to Sankofa and Kaakyire as at 31 October 2020.

| Statement of Financial Position |

Sankofa (GH¢’000) |

Kaakyire (GH¢’000) |

| Non-current assets |

|

|

| Property, Plant and Equipment |

37,000 |

30,000 |

| Investment Property |

5,000 |

– |

| Investments |

24,000 |

– |

| Total Non-current assets |

66,000 |

30,000 |

| Current assets |

|

|

| Inventory |

9,000 |

8,000 |

| Other current assets |

21,000 |

14,000 |

| Total Current assets |

30,000 |

22,000 |

| Total assets |

96,000 |

52,000 |

| Equity and liabilities |

|

|

| Ordinary shares (issued @ GH¢2.50) |

20,000 |

8,000 |

| Retained earnings |

26,000 |

16,000 |

| Total Equity |

46,000 |

24,000 |

| Non-current liabilities |

|

|

| 10% debentures |

11,900 |

12,000 |

| Current liabilities |

|

|

| Payables |

38,100 |

16,000 |

| Total Equity and liabilities |

96,000 |

52,000 |

Additional information:

i) On 1 November 2018, Sankofa purchased 2.4 million of the ordinary shares of Kaakyire when Kaakyire’s retained earnings balance stood at GH¢11 million. There have been no movements in share capital since the acquisition. As part of the consideration given for the shares acquired, the shareholders of Kaakyire accepted 1 million shares worth GH¢7 million in Sankofa at acquisition. The remaining consideration was agreed to be paid on 31 October 2020 for GH¢12.1 million. The present values of GH¢1 receivable based on 10% (considered to be an appropriate discount rate for Sankofa) are as follows:

| Present Value of GH¢1 receivable |

| In one year’s time: |

| In two years’ time: |

Entries have been correctly passed for the effects of all of the above, including any unwound discounts, except for the final payment made on 31 October 2020.

ii) At acquisition, the fair values of Kaakyire’s assets, liabilities, and contingencies were equal to their carrying amounts, with the exception of the following assets:

| Carrying amount (GH¢’000) |

Fair value (GH¢’000) |

| Trade receivables |

1,250 |

| Inventory |

1,500 |

| Properties |

14,000 |

The properties had a remaining useful life of 10 years. No items of property were sold during the two years to 31 October 2020. The inventory and the receivable were realised during the post-acquisition period.

iii) On 1 November 2019, Kaakyire sold an item of plant to Sankofa for GH¢5 million. Kaakyire originally bought the plant from Gyidie for GH¢6 million, and Kaakyire had provided accumulated depreciation of GH¢2.2 million up to the date of sale. Kaakyire considered the plant to have a remaining useful life of 5 years at the date of transfer.

iv) The Investment Property in the books of Sankofa represents an office facility that was completed on 1 November 2018 at the cost of GH¢3.5 million. The useful economic life of the facility was estimated at 20 years. Immediately after the acquisition of Kaakyire, Sankofa began to rent this property out to Kaakyire under a lease agreement. Sankofa Group values its investment properties using the fair value model under IAS 40 Investment Properties and its owner-occupied properties using the cost model under IAS 16 Property, Plant and Equipment.

v) On 1 November 2019, Sankofa acquired 30% of the ordinary shares of Kaboom at the cost of GH¢6 million. During the year ended 31 October 2020, Kaboom reported a profit after tax of GH¢2 million. No dividends were paid or declared by Kaboom during the period. At year-end, Kaboom’s inventory included GH¢1.2 million worth of goods bought from Sankofa during the year to October 2020. Sankofa charges a 25% margin on all sales.

On 31 October 2019, Goodwill acquired in Kaakyire was attributed with an impairment loss of GH¢0.5 million. The group’s policy is to measure non-controlling interest at the proportion of the fair value of the subsidiary’s net assets.

Required:

Prepare the Consolidated Statement of Financial Position for the Sankofa Group as at 31 October 2020.