- 30 Marks

CR – Nov 2018 – L3 – SA – Q1a – Consolidated Financial Statements (IFRS 10)

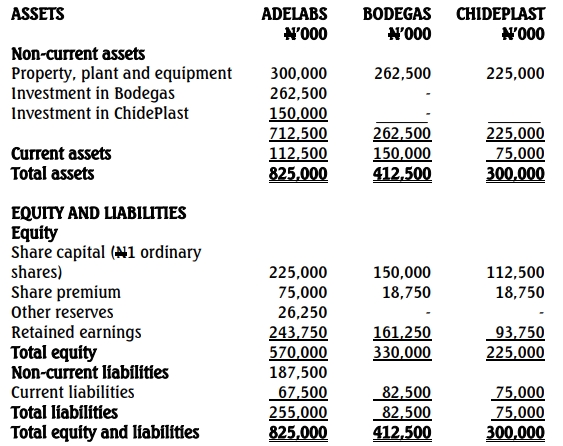

Prepare a consolidated statement of financial position for Adegaga Laboratories Plc., including the effects of an acquisition and goodwill impairment.

Question

Adegaga Laboratories Plc (“AdeLabs”) is one of the largest companies in Nigeria engaged in cosmetic development and manufacturing. Its largest customer base is in the healthcare sector for post-surgery patients and the Nigeria movie industry (aka Nollywood). In the prior financial period, AdeLabs’ expansion strategy has been largely focused on growth by acquisition and joint ventures.

Additional Information:

- As part of this, AdeLabs acquired 80% of the equity share capital of Bodegas Limited (“Bodegas”) on January 1, 2015, when the retained earnings of Bodegas was N93.75 million. Following the share acquisition, AdeLabs had control over Bodegas – no shares have been issued by Bodegas following the acquisition. The non-controlling interest in Bodegas was measured at its fair value of N20 million at the date of acquisition.

- On January 1, 2016, AdeLabs acquired 50% of the equity share capital of ChidePlastics Limited (“ChidePlast”) when the retained earnings of ChidePlast was N41.25 million. This acquisition was classified as a joint venture in accordance with IFRS 11 Joint Arrangements. ChidePlast has not issued any shares since the acquisition date.

- The balance on “other reserves” relates to movements in the values of investments in Bodegas and ChidePlast in the books of AdeLabs. N18.75 million relates to Bodegas, and the remainder to ChidePlast.

- AdeLabs’ non-current liabilities relate to a borrowing (long-term) taken out on January 1, 2017. This borrowing has an agreed coupon rate of 4% p.a., and the interest expense due in respect of 2017 has been paid and accounted for in profit for the year. The effective interest rate estimated with this financial liability is 8% p.a.

- As part of its annual impairment review, AdeLabs concluded that the goodwill on the acquisition of Bodegas was impaired by 20% at December 31, 2017. No other impairments of goodwill have arisen.

- AdeLabs sold goods to ChidePlast with a value of N75 million and a selling margin of 40% in November 2017. As at year-end December 31, 2017, 75% of these items are unsold.

Accounts for all companies are made up to December 31 annually.

Required:

Prepare for Adegaga Laboratories Plc:

- A consolidated statement of financial position as at December 31, 2017. (20 Marks)

- On January 1, 2018, AdeLabs acquired an additional 10% of the equity shares of Bodegas. The purchase consideration for this additional acquisition was N52,500,000.

i. Briefly explain how this additional acquisition will impact the preparation of AdeLabs’ consolidated financial statements for the year ended December 31, 2017. (4 Marks)

ii. Calculate the adjustment that will be required to be made to AdeLabs’ statement of financial position as a result of this acquisition. (6 Marks)

Find Related Questions by Tags, levels, etc.