Question Tag: Equity

- 7 Marks

CR – May 2017 – L3 – Q6b – Financial Instruments (IFRS 9, IAS 32, IAS 39)

Distinguish between liability and equity under IAS 32 with examples.

Question

It is important for entities to understand and properly classify their financial instruments. This is because some financial instruments may have features of both debt and equity, which can lead to inconsistency in reporting. To this end, financial reporting standards provide guidance on the difference between financial instruments classified as equity and liabilities.

Required:

With relevant examples, distinguish between liability and equity under IAS 32: Financial Instruments Presentation. (7 Marks)

Find Related Questions by Tags, levels, etc.

- 15 Marks

FM – Nov 2022 – L3 – Q5 – Business Valuation Techniques

Calculate the equity value of APL using SVA and outline three methods for funding the MBO.

Question

Aderupoko Plc (ADP), a large listed media group, has been the holding company of Adamu Publishers Limited (APL) since 2015. The publishing company (APL) is 100% owned by ADP since inception.

Recently, the directors of APL informed ADP’s board of their readiness to make a management buy-out (MBO) of APL. Accordingly, ADP’s board decided to value APL using the shareholder value analysis method (SVA). ADP’s board estimates that APL has a four-year competitive advantage over its competitors (to 30 September 2024) and the following data regarding APL’s value drivers and additional financial information has been collected:

| Year to 30 September | 2021 | 2022 | 2023 | 2024 | 2025+ |

|---|---|---|---|---|---|

| Sales growth (%) | 5% | 4% | 3% | 2% | 0% |

| Operating profit margin | 8% | 9% | 10% | 10% | 10% |

| Incremental non-current asset investment (% of sales increase) | 5% | 6% | 3% | 2% | 0% |

| Incremental working capital investment (% of sales increase) | 6% | 5% | 4% | 4% | 0% |

Financial Information:

- Sales for the current year to 30 September 2020: ₦80 million

- Annual depreciation (equal to annual replacement of non-current asset expenditure): ₦2.0 million

- Par value of 6% debentures in issue (current market value ₦95.00, nominal value ₦100): ₦10.0 million

- Short-term investments held: ₦0.8 million

- Company tax rate: 20%

- Current WACC: 10%

Required:

a. Calculate the value of APL’s equity using SVA.

(12 Marks)

b. Outline three methods by which APL’s directors might raise the funds necessary for the proposed MBO of the company. (3 Marks)

(Total 15 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Competitive Advantage, Equity, Funding Methods, MBO, SVA, Valuation

- Level: Level 3

- Topic: Business Valuation Techniques

- Series: NOV 2022

- 1 Marks

BL – Nov 2020 – L1 – SA – Q3 – Partnership Law

Objective questions testing knowledge on Nigerian government functions, customary law, and partnership structures.

Find Related Questions by Tags, levels, etc.

- Tags: Equity, Natural Justice, Partnership Types

- Level: Level 1

- Topic: Partnership Law

- Series: NOV 2020

- 15 Marks

FR – May 2017 – L2 – SB – Q5 – Preparation of Financial Statements

Discuss distinguishing features of debt and equity presentation under IFRS and explain the impact of classification on financial statements.

Question

The difference between debt and equity in an entity’s statement of financial position is not easily distinguishable for preparers of financial statements. Debts and equity financial instruments may have similar characteristics, which may lead to inconsistency of reporting.

Required:

- Discuss the main distinguishing features in the presentation of debt and equity under International Financial Reporting Standards (IFRS) with clear examples.

(10 Marks) - Explain why it is important for entities to understand the impact of the classification of a financial instrument as debt or equity in the financial statement.

(5 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Classification, Consistency, Debt, Equity, Financial instruments, IFRS, Presentation

- Level: Level 2

- Topic: Preparation of Financial Statements

- Series: MAY 2017

- 15 Marks

FR – May 2024 – L2 – SB – Q6 – Financial Instruments (IAS 32)

Discuss how to treat transactions of debt and equity instruments in Akwa Nig. Limited under IAS 32.

Question

Akwa Nig. Limited is a private limited company planning to be registered with the Nigeria Exchange Limited (NGX). The company is engaged in the conversion of petrol engines into compressed gas engines.

The following are the transactions of the company in respect of its debts and equity instruments.

Transaction 1:

Akwa Nig. Limited issued 40 million non-redeemable N1 preference shares at par value. Under the terms relating to the preference shares, a dividend is payable on the preference shares only if Akwa Nig. Limited also pays a dividend on its ordinary shares for the same period. (5 Marks)

Transaction 2:

Akwa Nig. Limited entered into a contract with a supplier to buy a significant item of equipment. Under the terms of the agreement, the supplier will receive ordinary shares with an equivalent value of N5 million one year after the equipment is delivered. (5 Marks)

Transaction 3:

The directors of Akwa Nig. Limited, on becoming directors, are required to invest a fixed agreed sum of money in a special class of N1 ordinary shares that only directors hold. Dividend payments on the shares are discretionary and are ratified at the Annual General Meeting (AGM) of the company. When a director’s service contract expires, Akwa Nig. Limited is required to repurchase the shares at their nominal value. (5 Marks)

A senior accountant in your company (Akwa Nig. Limited) has asked for your advice on how the above transactions should be treated in the financial statements of your company in accordance with IAS 32 – Financial Instruments: Presentation.

Required:

Write a memo on the above request, discussing and justifying how each of the transactions should be treated in the financial statements, in accordance with IAS 32 – Financial Instruments: Presentation.

Find Related Questions by Tags, levels, etc.

- Tags: Debt, Equity, Financial instruments, Financial Statements, IAS 32, Preference shares

- Level: Level 2

- Topic: Financial Instruments (IAS 32, IFRS 9)

- Series: MAY 2024

- 15 Marks

FR – Nov 2015 – L2 – Q5 – Consolidated Financial Statements (IFRS 10)

Prepare the consolidated statement of financial position and calculate goodwill and non-controlling interest for UDO Group Plc.

Question

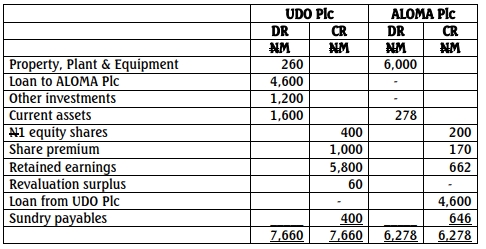

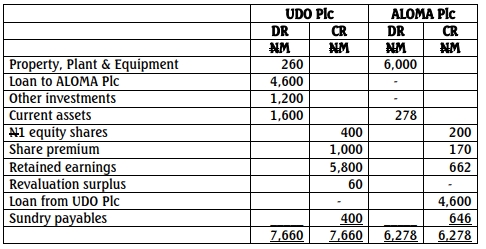

The trial balance of UDO Plc and its subsidiary, ALOMA Plc, as at December 31, 2014, is given below:

UDO Plc acquired 75% of ALOMA Plc on January 1, 2014, for N1,300,000,000, when the retained earnings of ALOMA Plc were N600 million and the share premium was N170 million. Neither the acquisition nor the loan notes obtained to finance the purchase were recorded in the trial balance. There has been no impairment of goodwill, and no change in share capital since acquisition. It is the group policy to value the non-controlling interest at fair value, which was estimated to be N160 million.

Required:

Prepare the consolidated statement of financial position of UDO Group Plc as at December 31, 2014.

Find Related Questions by Tags, levels, etc.

- 1 Marks

BL – May 2012 – L1 – SA – Q1 – Sources of Nigerian Law

Identifying the problem equity sought to address in common law.

Find Related Questions by Tags, levels, etc.

- Tags: Business Law, Common Law, Equity, Nigerian Legal System

- Level: Level 1

- Topic: Sources of Nigerian Law

- Series: MAY 2012

- 1 Marks

TAX – May 2021 – L1 – SA – Q1 – Introduction to Taxation

Multiple-choice question assessing knowledge of the principles of taxation.

Find Related Questions by Tags, levels, etc.

- Tags: Certainty, Convenience, Equity, Residency, Simplicity, Tax Principles

- Level: Level 1

- Topic: Introduction to Taxation

- Series: MAY 2021

- 7 Marks

CR – May 2017 – L3 – Q6b – Financial Instruments (IFRS 9, IAS 32, IAS 39)

Distinguish between liability and equity under IAS 32 with examples.

Question

It is important for entities to understand and properly classify their financial instruments. This is because some financial instruments may have features of both debt and equity, which can lead to inconsistency in reporting. To this end, financial reporting standards provide guidance on the difference between financial instruments classified as equity and liabilities.

Required:

With relevant examples, distinguish between liability and equity under IAS 32: Financial Instruments Presentation. (7 Marks)

Find Related Questions by Tags, levels, etc.

- 15 Marks

FM – Nov 2022 – L3 – Q5 – Business Valuation Techniques

Calculate the equity value of APL using SVA and outline three methods for funding the MBO.

Question

Aderupoko Plc (ADP), a large listed media group, has been the holding company of Adamu Publishers Limited (APL) since 2015. The publishing company (APL) is 100% owned by ADP since inception.

Recently, the directors of APL informed ADP’s board of their readiness to make a management buy-out (MBO) of APL. Accordingly, ADP’s board decided to value APL using the shareholder value analysis method (SVA). ADP’s board estimates that APL has a four-year competitive advantage over its competitors (to 30 September 2024) and the following data regarding APL’s value drivers and additional financial information has been collected:

| Year to 30 September | 2021 | 2022 | 2023 | 2024 | 2025+ |

|---|---|---|---|---|---|

| Sales growth (%) | 5% | 4% | 3% | 2% | 0% |

| Operating profit margin | 8% | 9% | 10% | 10% | 10% |

| Incremental non-current asset investment (% of sales increase) | 5% | 6% | 3% | 2% | 0% |

| Incremental working capital investment (% of sales increase) | 6% | 5% | 4% | 4% | 0% |

Financial Information:

- Sales for the current year to 30 September 2020: ₦80 million

- Annual depreciation (equal to annual replacement of non-current asset expenditure): ₦2.0 million

- Par value of 6% debentures in issue (current market value ₦95.00, nominal value ₦100): ₦10.0 million

- Short-term investments held: ₦0.8 million

- Company tax rate: 20%

- Current WACC: 10%

Required:

a. Calculate the value of APL’s equity using SVA.

(12 Marks)

b. Outline three methods by which APL’s directors might raise the funds necessary for the proposed MBO of the company. (3 Marks)

(Total 15 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Competitive Advantage, Equity, Funding Methods, MBO, SVA, Valuation

- Level: Level 3

- Topic: Business Valuation Techniques

- Series: NOV 2022

- 1 Marks

BL – Nov 2020 – L1 – SA – Q3 – Partnership Law

Objective questions testing knowledge on Nigerian government functions, customary law, and partnership structures.

Find Related Questions by Tags, levels, etc.

- Tags: Equity, Natural Justice, Partnership Types

- Level: Level 1

- Topic: Partnership Law

- Series: NOV 2020

- 15 Marks

FR – May 2017 – L2 – SB – Q5 – Preparation of Financial Statements

Discuss distinguishing features of debt and equity presentation under IFRS and explain the impact of classification on financial statements.

Question

The difference between debt and equity in an entity’s statement of financial position is not easily distinguishable for preparers of financial statements. Debts and equity financial instruments may have similar characteristics, which may lead to inconsistency of reporting.

Required:

- Discuss the main distinguishing features in the presentation of debt and equity under International Financial Reporting Standards (IFRS) with clear examples.

(10 Marks) - Explain why it is important for entities to understand the impact of the classification of a financial instrument as debt or equity in the financial statement.

(5 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Classification, Consistency, Debt, Equity, Financial instruments, IFRS, Presentation

- Level: Level 2

- Topic: Preparation of Financial Statements

- Series: MAY 2017

- 15 Marks

FR – May 2024 – L2 – SB – Q6 – Financial Instruments (IAS 32)

Discuss how to treat transactions of debt and equity instruments in Akwa Nig. Limited under IAS 32.

Question

Akwa Nig. Limited is a private limited company planning to be registered with the Nigeria Exchange Limited (NGX). The company is engaged in the conversion of petrol engines into compressed gas engines.

The following are the transactions of the company in respect of its debts and equity instruments.

Transaction 1:

Akwa Nig. Limited issued 40 million non-redeemable N1 preference shares at par value. Under the terms relating to the preference shares, a dividend is payable on the preference shares only if Akwa Nig. Limited also pays a dividend on its ordinary shares for the same period. (5 Marks)

Transaction 2:

Akwa Nig. Limited entered into a contract with a supplier to buy a significant item of equipment. Under the terms of the agreement, the supplier will receive ordinary shares with an equivalent value of N5 million one year after the equipment is delivered. (5 Marks)

Transaction 3:

The directors of Akwa Nig. Limited, on becoming directors, are required to invest a fixed agreed sum of money in a special class of N1 ordinary shares that only directors hold. Dividend payments on the shares are discretionary and are ratified at the Annual General Meeting (AGM) of the company. When a director’s service contract expires, Akwa Nig. Limited is required to repurchase the shares at their nominal value. (5 Marks)

A senior accountant in your company (Akwa Nig. Limited) has asked for your advice on how the above transactions should be treated in the financial statements of your company in accordance with IAS 32 – Financial Instruments: Presentation.

Required:

Write a memo on the above request, discussing and justifying how each of the transactions should be treated in the financial statements, in accordance with IAS 32 – Financial Instruments: Presentation.

Find Related Questions by Tags, levels, etc.

- Tags: Debt, Equity, Financial instruments, Financial Statements, IAS 32, Preference shares

- Level: Level 2

- Topic: Financial Instruments (IAS 32, IFRS 9)

- Series: MAY 2024

- 15 Marks

FR – Nov 2015 – L2 – Q5 – Consolidated Financial Statements (IFRS 10)

Prepare the consolidated statement of financial position and calculate goodwill and non-controlling interest for UDO Group Plc.

Question

The trial balance of UDO Plc and its subsidiary, ALOMA Plc, as at December 31, 2014, is given below:

UDO Plc acquired 75% of ALOMA Plc on January 1, 2014, for N1,300,000,000, when the retained earnings of ALOMA Plc were N600 million and the share premium was N170 million. Neither the acquisition nor the loan notes obtained to finance the purchase were recorded in the trial balance. There has been no impairment of goodwill, and no change in share capital since acquisition. It is the group policy to value the non-controlling interest at fair value, which was estimated to be N160 million.

Required:

Prepare the consolidated statement of financial position of UDO Group Plc as at December 31, 2014.

Find Related Questions by Tags, levels, etc.

- 1 Marks

BL – May 2012 – L1 – SA – Q1 – Sources of Nigerian Law

Identifying the problem equity sought to address in common law.

Find Related Questions by Tags, levels, etc.

- Tags: Business Law, Common Law, Equity, Nigerian Legal System

- Level: Level 1

- Topic: Sources of Nigerian Law

- Series: MAY 2012

- 1 Marks

TAX – May 2021 – L1 – SA – Q1 – Introduction to Taxation

Multiple-choice question assessing knowledge of the principles of taxation.

Find Related Questions by Tags, levels, etc.

- Tags: Certainty, Convenience, Equity, Residency, Simplicity, Tax Principles

- Level: Level 1

- Topic: Introduction to Taxation

- Series: MAY 2021