- 20 Marks

FM – May 2017 – L3 – Q2 – Financing Decisions and Capital Markets

Calculate gearing ratio, rights issue impacts, and shareholder implications.

Question

LL Plc. is a large engineering company. Its ordinary shares are quoted on the Stock Exchange.

LL Plc.’s Board is concerned that the company’s gearing level is too high and that this is having a detrimental impact on its market capitalisation. As a result, the Board is considering a restructuring of LL Plc.’s long-term funds, details of which are shown here as at 28 February, 2017:

| Funding Source | Total Par Value (₦m) | Market Value |

|---|---|---|

| Ordinary Share Capital (50k) | 67.5 | ₦2.65/share ex-div |

| 7% Preference Share Capital (₦1) | 60.0 | ₦1.44/share ex-div |

| 4% Redeemable Debentures (₦100) | 45.0 | 90% ex-int |

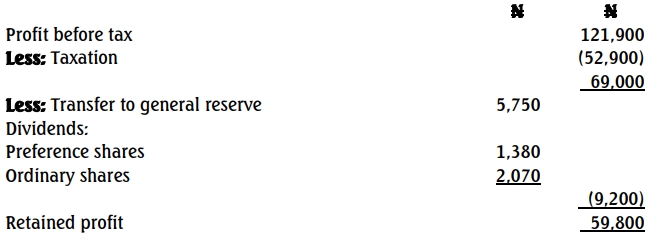

The debentures are redeemable in 2022. LL Plc.’s earnings for the year to 28 February, 2017 were ₦32.4 million and are expected to remain at this level for the foreseeable future. Retained earnings, as at 28 February, 2017 were ₦73.2 million.

The Board is considering a 1 for 9 rights issue of ordinary shares, and this additional funding would be used to redeem 60% of LL Plc.’s redeemable debentures at par. However, some of LL Plc.’s directors are concerned that this issue of extra ordinary shares will cause the company’s ordinary share price and its earnings per share (EPS) to fall by an excessive amount, to the detriment of LL Plc.’s shareholders. Accordingly, they are arguing that the rights issue should be designed so that the EPS is not diluted by more than 5%.

The Directors wish to assume that the income tax rate will be 21% for the foreseeable future and the tax will be payable in the same year as the cash flows to which it relates.

Required:

a. i. Calculate LL Plc.’s gearing ratio using both book and market values. (5 Marks)

ii. Discuss, with reference to relevant theories, why LL Plc.’s Board might have concerns over the level of gearing and its impact on LL Plc.’s market capitalisation. (6 Marks)

b. Assuming that a 1 for 9 rights issue goes ahead, calculate the theoretical ex-rights price of LL Plc.’s ordinary share and the value of a right. (3 Marks)

c. Discuss the Directors’ view that the rights issue will cause the share price and the EPS to fall by an excessive amount, to the detriment of LL Plc.’s ordinary shareholders. Your discussion should be supported by relevant calculations. (6 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Capital structure, EPS, Rights Issue, Share Price

- Level: Level 3