- 20 Marks

TAX – May 2015 – L2 – SA – Q2 – Personal Income Tax (PIT)

Tax compliance requirements and tax liability calculation for Mr. Sola Abijah based on employment and part-time income.

Question

You have been approached by Mr. Sola Abijah, a political science graduate who did his compulsory National Youth Service in a media organization in 2009. On completion of National Youth Service in January 2010, he was offered a part-time job as a freelance writer in two international newspapers. He receives an income (net of Withholding tax) based on the articles he writes that are published by the newspapers. In March 2010, he joined a popular political party and served as the party’s temporary Public Relations Officer, also on a part-time income basis.

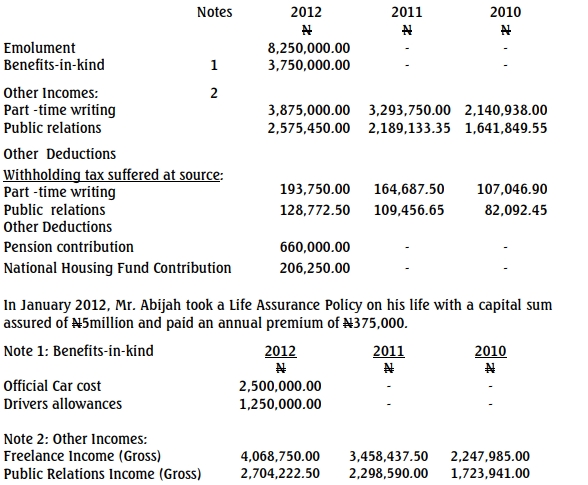

On 2 January 2012, he secured employment on full-time basis as Senior Manager, Corporate Affairs, in Jola Investment Enterprises on a salary of ₦12,000,000 per annum.

He was ignorant of the requirements for filing Tax Returns and paying tax to Government. He has been served a warning by the State Board of Internal Revenue (SBIR) to desist from non-disclosure of his other incomes, failing which, a Best of Judgement assessment may be raised on him by the tax inspector.

Mr. Abijah has approached you to provide tax advisory services in respect of his income tax compliance requirements and the likely tax liability that may be imposed on him by the SBIR.

The following additional information has been presented to you:

Requirements:

(a) State the difference between employment income and part-time income. (3 Marks)

(b) Explain why, when and to whom taxpayers are expected to file income tax returns. (5 Marks)

(c) Explain the circumstances that may arise to cause a tax authority to raise a Best of Judgement Assessment. (4 Marks)

(d) Compute the tax liability on Mr. Abijah’s Total Income. (8 Marks)

Find Related Questions by Tags, levels, etc.