- 20 Marks

FR – May 2024 – L2 – SA – Q3 – Consolidated Financial Statements

Preparation of consolidated financial statements, calculation of goodwill, and non-controlling interest.

Question

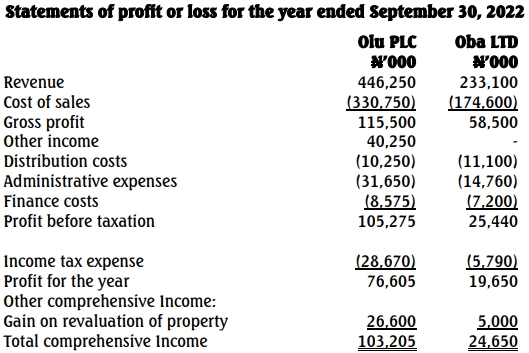

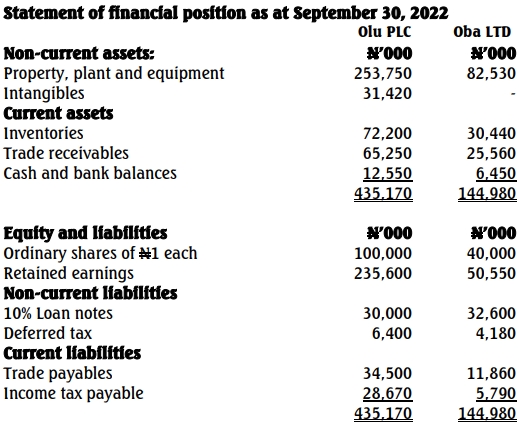

Olu Nigeria PLC has a subsidiary, Oba Limited, which it acquired on January 1, 2022. The financial statements of the companies are detailed below:

Statements of Profit or Loss for the year ended September 30, 2022

Additional Information:

- Olu PLC acquired its 70% interest in Oba Limited through a share exchange of three shares in Olu PLC for every five shares in Oba Limited. At the acquisition date, the shares of Olu PLC were sold at ₦8.10 each on the Nigerian Exchange (NGX). The parent company has not recorded this share issue in its books.

- At the acquisition date, the fair value of Oba Limited’s assets equaled their carrying amounts except for an item of plant, which had a fair value of N30,000,000 above its carrying amount. This fair value increase has not been adjusted in Oba Limited’s books. The plant’s remaining life at acquisition was five years.

- During the year, Oba Limited transferred goods worth N40,000,000 to Olu PLC. These goods were invoiced at cost plus 25%, and only a quarter of them were sold by Olu PLC at year-end.

- Included in the other income was N6,550,000 received from Oba Limited as interest paid on a loan granted by Olu PLC. The loan was fully repaid before September 30, 2022.

- An impairment test revealed a goodwill impairment of N28,000,000 at the acquisition date.

- It is the group’s policy to value non-controlling interests at fair value. The prevailing market price per ordinary share of Oba Limited at January 1, 2022, was ₦5.05.

- The gain on the revaluation of property arose from an independent valuation of the group’s property in September 2022.

- Administrative expenses of Oba Limited included N10,000,000 paid as management fees to Olu PLC, and the income has been duly recorded in Olu PLC’s books.

- Income and expenses accrue evenly over the period.

Required:

a. Prepare the consolidated statement of profit or loss and other comprehensive income for Olu Group for the year ended September 30, 2022. (12 Marks)

b. Calculate the goodwill on acquisition and the non-controlling interest at the reporting date. (4 Marks)

c. IFRS 10 – Consolidated Financial Statements states that a parent must present consolidated financial statements for its investments in subsidiaries.

Required:

State FOUR exceptions to this pronouncement. (4 Marks)

Find Related Questions by Tags, levels, etc.