- 20 Marks

PM – May 2021 – L2 – Q6 – Costing Systems and Techniques

Evaluate production costs per unit using both absorption and activity-based costing for Chukwukah Nigeria Limited.

Question

Chukwukah Nigeria Limited manufactures three products, JEL, JET and JAL. Demand for

products JEL and JET is relatively elastic whilst demand for product JAL is relatively

inelastic. Each product uses the same materials and the same type of direct labour but

in different quantities. For many years, the company has been using full absorption

costing and absorbing overheads on the basis of direct labour hours. Selling prices are

then determined using cost plus pricing. This is common in the company‟s industry with

most competitors applying a standard mark-up.

Budgeted production and sales volumes for JEL, JET and JAL for the next year are

25,000, 20,000 and 27,600 units respectively.

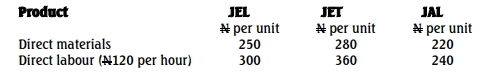

The budgeted direct costs of the three products are shown below:

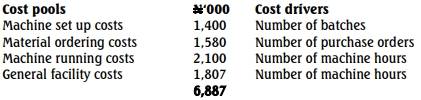

In the coming year, Chukwukah also expects to incur indirect production costs of

N6,887,000, which are analysed as follows:

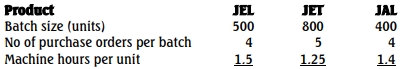

The following additional data relates to each product:

The management of Chukwukah Nigeria Limited wants to boost sales revenue in order to

increase profits but its capacity to do this is limited because of its use of cost plus

pricing and the application of standard mark-up. The management accountant has

suggested using activity based costing (ABC) instead of full absorption costing, since

this will alter the cost of the products and may therefore enable a different price to be

charged.

Required:

a. Calculate the budgeted full production cost per unit of each product using absorption costing, rounded to two decimal places. (6 Marks)

b. Calculate the budgeted full production cost per unit of each product using activity-based costing (ABC), rounded to two decimal places. (8 Marks)

c. Discuss the impact on selling prices and sales volumes of each product that could result from changing to activity-based costing. (6 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Absorption Costing, Activity-Based Costing, Direct Costs, Elasticity of Demand, Pricing

- Level: Level 2

- Topic: Costing Systems and Techniques

- Series: MAY 2021