- 20 Marks

FM – May 2021 – L3 – Q4 – Foreign Exchange Risk Management

Evaluate economic exposure, forecast exchange rates with inflation, calculate expected receipts using forward and money-market hedges, and discuss problems with futures contracts.

Question

Kingston Plc. (KP) is a Nigerian company based in Aba. KP exports finished products to and imports raw materials from a company Central Africa, with currency of Central Dollar (C$).

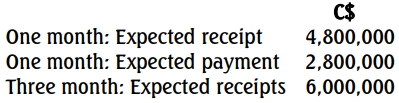

KP has the following expected transactions:

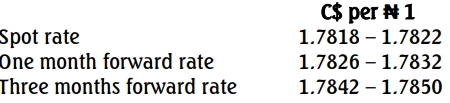

You have collected the following information:

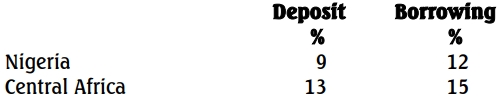

Money market rate for KP:

a. Discuss the significance to a multinational company of economic exposure. (5 Marks)

b. Explain how inflation rates can be used to forecast exchange rates. (3 Marks)

c. Calculate the expected naira receipts in one month and in three months using the forward market. (3 Marks)

d. Calculate the expected naira receipts in three months using a money-market hedge and recommend whether a forward market hedge or a money-market hedge should be used. (5 Marks)

e. Discuss FOUR possible problems of using futures contracts to hedge exchange rate risks. (4 Marks)

Find Related Questions by Tags, levels, etc.