- 15 Marks

CR – Nov 2023 – L3 – Q4a – Business Valuation

Determine appropriate valuation methods and price range for Odenkey Plc based on financial statements and additional information provided.

Question

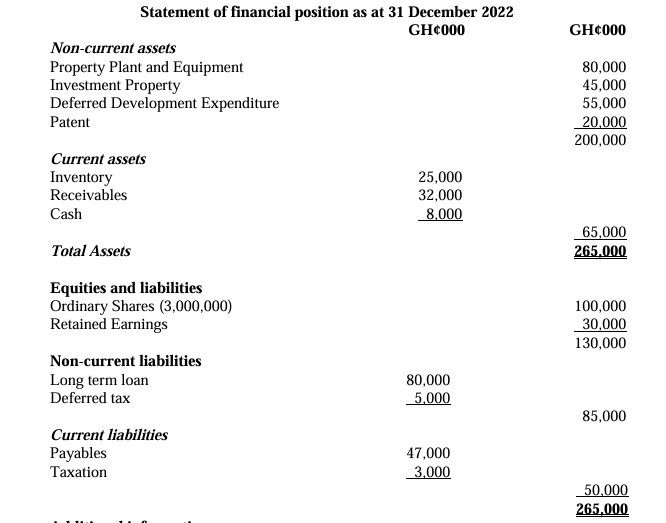

a) The Directors of Odenkey Plc have decided to sell their business and have begun a search for organisations interested in the purchase. As a Consultant, you have been asked to determine the appropriate range of price per share suitable for the company. Relevant information is as follows:

Additional information:

- The receivables include GH¢12,000,000 of revenue for credit sales made on a ‘sale or return’ basis. On 31 December 2022, customers who had not paid for the goods, had the right to return GH¢5,000,000 worth of them. Odenkey Plc applied a markup on cost of 25% on all these sales. Based on previous transactions, it is expected that 80% of the goods will be returned.

- The property, plant and equipment includes a building that was originally acquired for GH¢20,000,000 five years ago with an initial estimated useful life of 20 years. The property was revalued to GH¢18,000,000 as at 31 December 2022, and the revaluation reserve is yet to be recognised in the financial statement. Due to degradation of the land on which the building stands, the company undertook an impairment review and it was found that, the fair value of the property as at 31 December 2022 is estimated to be GH¢17,000,000. The value in use of the property is calculated as being GH¢16,000,000.

- The patent was originally acquired 2 years ago and the rights were set at 50 years from the date the patent was originally purchased. The patent was amortised by Odenkey Plc using straight line method over the remaining copyright period. However, recent legislative changes passed on 1 January 2022 have extended the patent period forever. The Research and Development departments projects net future cashflow of GH¢4,500,000 per year from the patent even though the prices of similar patents on the market are valued at GH¢ 18,500,000.

- The company had a retained earnings balance of GH¢5,000,000 as at 31 December 2021. It has always practiced a dividend payout ratio of 35% when it makes profit during the year.

- The following information relates to Odenkey Plc and a competitor Odafomtim Ltd: Odenkey Plc Odafomtim Ltd Number of Shares 3,000,000 500,000 5 years’ average sales growth 8% 9% 5 years’ average growth in EBIT 6% 10.5% P/E ratio as at 31 December 2022 – 18.61 Estimated return on equity 9.5% 12%

- The company’s cost of capital is 25%.

- Odafomtim Ltd is a listed firm and has a sizeable market share.

Required:

i) Use the information provided to suggest FOUR (4) valuations which prospective purchasers might make.

(12 marks)

ii) Comment on the appropriateness of the range of price per share of Odenkey Plc that the Directors can offer.

(3 marks)

Find Related Questions by Tags, levels, etc.