- 30 Marks

CR – May 2016 – L3 – Q1 – Presentation of Financial Statements (IAS 1)

Explain earnings management, calculate goodwill, and prepare a consolidated statement of cash flows for Joy-land Group.

Question

Given that accrual accounting tends to mask actual cash flow performance, stock analyst and rating agencies are generally more interest in cash flow. The directors of Joy-land Plc have called for the cash flow statement of the group so as to have a view of earnings performance devoid of accruals. The following draft group financial statements relate to Joy-land Plc.

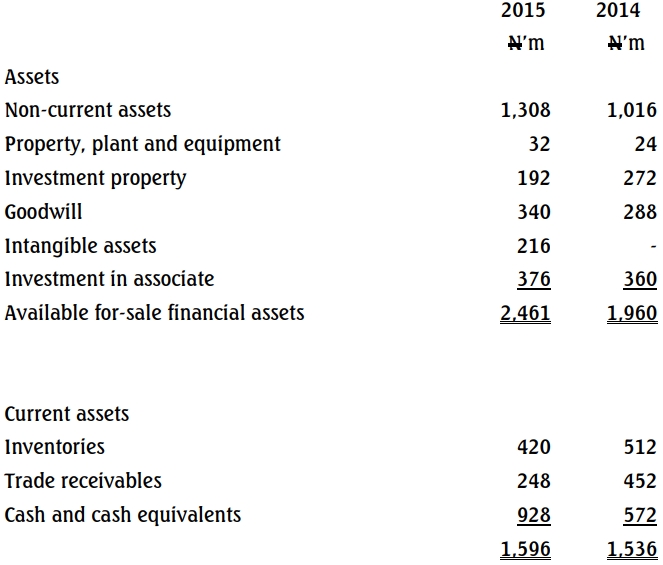

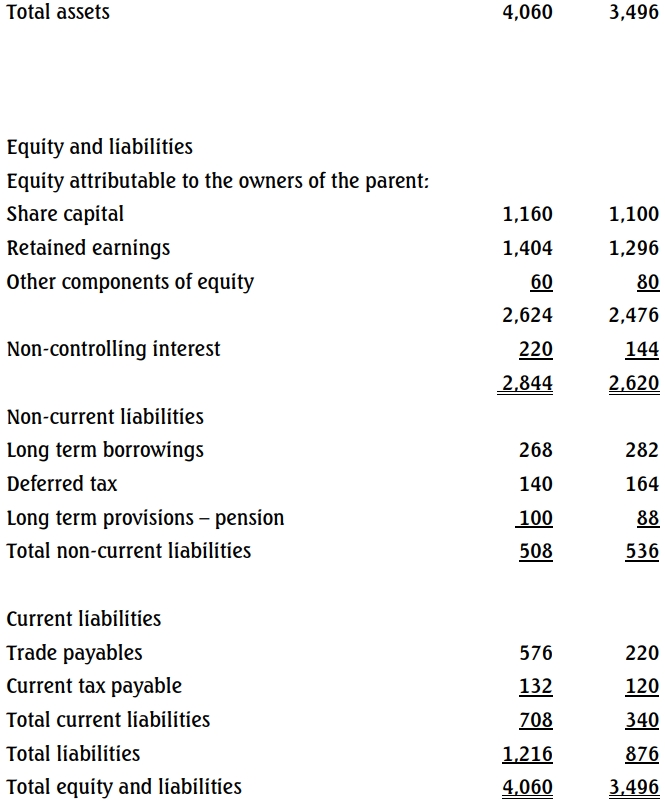

Joy-land Plc Group: Statement of financial position as of November 30

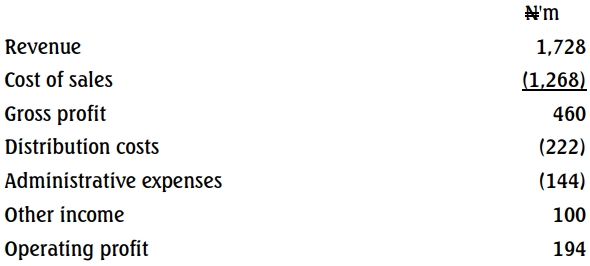

Joy-land Group: Statement of comprehensive income for the year ended November 30, 2015.

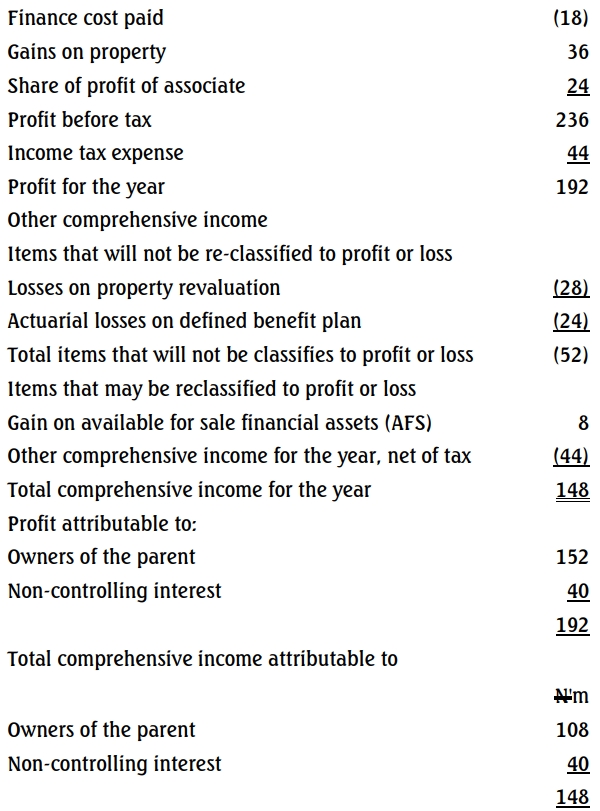

Joy-land Group: Statement of comprehensive income for the year ended November 30, 2015.

Joy-land Group: Statement of comprehensive income for the year ended November 30, 2015.

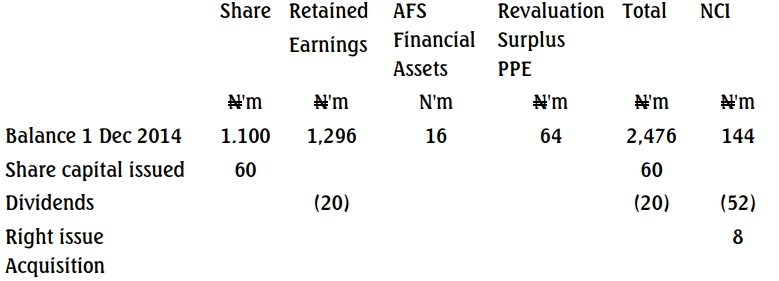

Joy-land Group: Statement of changes in equity for the year ended November 30, 2015

The following additional information relates to the financial statements of Joy-land

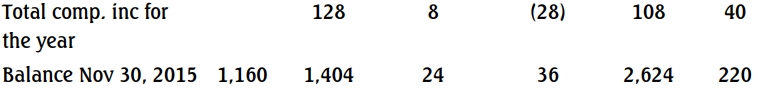

(i) On December 1 2013, Joy-land acquired 8% of the ordinary shares of Talk peace. Joy-land had treated this investment as available for sale in the financial statement to November 30, 2014. On December 1, 2014. Joyland acquired a further 52% of the ordinary shares of Talk-peace and gained control of the company, the consideration for the acquisitions was as follows:

At December 1, 2014 the fair value of the 8% holding in talk peace held by Joy-land at the time of the business combination was N20 million and the fair value of the noncontrolling interest in Talk-peace was N80million. no gain or loss on the 8% holding in Talk-peace had been reported in the financial statement at December 1, 2014, the

purchase consideration at December 1, 2014 comprised cash of N60 million and share of N60million.

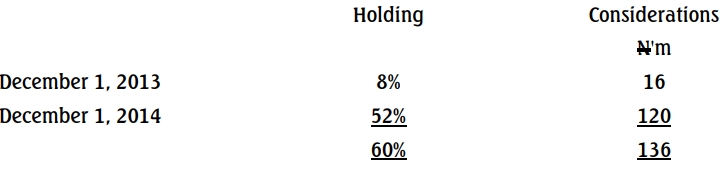

The fair value of identifiable net assets of Talk-peace at the date of acquisition comprised the following:

(ii) Goodwill Impairment

- Goodwill for all subsidiaries has undergone impairment testing for the financial year ending November 30, 2015.

- Impairment losses identified were specific to subsidiaries 100% owned by Joy-land.

(iii) Purchase of Research Project (IAS 38)

- On December 1, 2014, Joy-land purchased a research project from a third party for ₦32 million, which was recognized as an intangible asset under IAS 38.

- Additional costs incurred during the year include:

- ₦8 million to complete the research phase.

- ₦16 million for product development (capitalizable).

- ₦4 million for initial marketing costs (not capitalizable; already accounted for correctly).

- No other additions to intangible assets were recorded, except those from the acquisition of Talk-peace.

(iv) Rights Issue by Talk-peace

- On November 30, 2015, Talk-peace issued new shares on a 1 for 4 basis.

- The issue was fully subscribed and raised ₦20 million in cash.

(v) Investment Property (IAS 40)

- Joy-land uses the fair value model to measure its investment properties.

- During the year:

- Part of the air-conditioning system (carrying value: ₦2 million) was replaced with a new system costing ₦4 million.

- The replacement aligns with the treatment under IAS 40.

(vi) Sale of Surplus Land

- Joy-land sold surplus land with a carrying value of ₦40 million for:

- ₦60 million in cash, and

- Plant valued at ₦16 million (part of the consideration).

- The resulting gain on disposal has already been included in the income statement.

- Depreciation for property, plant, and equipment (PPE) for the year totaled ₦108 million.

(vii) Defined Benefit Scheme

- Joy-land operates a defined benefit pension scheme for select top executives and expatriates (in addition to its contributory pension scheme).

- Current-year figures for the defined benefit scheme:

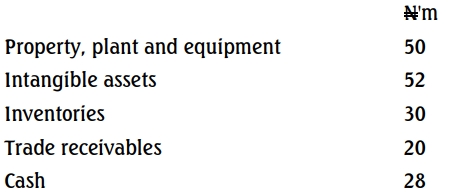

Description ₦’m Opening Balance (Dec 1, 2014) 88 Current Year Charge to P&L 16 Contributions Paid (28) Actuarial Loss to OCI 24 Closing Balance (Nov 30, 2015) 100

(viii) The associate company did not pay any dividends in the year.

(ix) Deferred tax of N40illion arose on the gains on available for sale investments in the year

Required

(a) As the CFO of the group, briefly explain to the legal and engineer directors what is meant by earnings management giving TWO examples of how accruals could be employed in the earning management. (3 marks)

N’m

Balance at the beginning, December 1, 2014 88

Charge to profit or loss for the year 16

Pension contributions paid during the year (28)

Actuarial loss to other comprehensive income 24

Balance at the end, November 30 2015 100

(b) Determine the goodwill arising on the acquisition of the subsidiary on December 1, 2014 and total goodwill impairments of the group as at November 30, 2015 statement of cash flow on the assumption that it is the policy of Joyland Plc to value Non-controlling interest at full fair value. (3 marks)

(c) Prepare a consolidated statement of cash flows for the Joy-land Group for the year ended November 30, 2015 using the indirect method under IAS 7 ‘statement of Cash flow.

Note; Ignore deferred taxation other than where is mention in the question.

Find Related Questions by Tags, levels, etc.