You are the Tax Controller of Rex Pharmaceuticals (Nigeria) Limited having its Head Office in Ketu, Epe Local Government of Lagos State.

In the past three years, the company had been subjected to taxes by different Revenue Authorities within Lagos State and indeed, the entire country.

Apart from the Companies Income Tax, the issue of Withholding Tax is an area where the company’s management is very much concerned. The Managing Director is worried that this multiplicity of taxes is taking its toll on the company’s financials.

The company is already facing myriads of problems ranging from outrageous cost of capital which had led to increase in cost of production and attendant decrease in profit. The company’s goods are becoming uncompetitive, compared to imported goods. The long-term effect is either reduction in workforce or relocation to a more favorable economic climate.

The Managing Director summoned you to his office and among the issues raised at the meeting were:

(i) as a corporate body, the company ought not to be subjected to multiplicity of taxes beyond the Companies Income Tax;

(ii) the jurisdiction of the tiers of Government in imposition and collection of taxes;

(iii) the Withholding Tax;

(iv) the Pay As You Earn as it affects the staff; and

(v) the Capital Gains Tax.

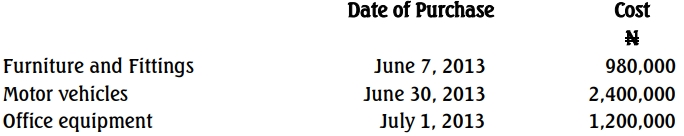

You have also been informed of the following:

- The company’s technical agreement with the foreign Head Office and the need to remit funds;

- The Non-Executive Directors;

- The Non-Resident directors are to receive N2,500,000;

- Centralization of staff PAYE deductions;

- Dividend payment to shareholders in different parts of the country. Those resident in Kogi are to receive N375,000;

- Land for a factory in Abuja purchased from Alhaji Garuba Maito who resides in Kano;

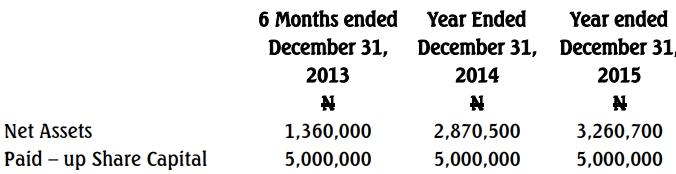

- Rex Pharmaceuticals received N4,500,000 as Net dividend from an associated company Laiketop Limited for the year ended September 30, 2014. In the Audited Financial Statements of Rex Pharmaceuticals for the year ended December 31, 2015, a dividend of N9,500,000 was proposed. Out of this amount, N3,500,000 was from dividend received from Laiketop Limited while the balance was from a Total Profit of N22,500,000 from other trading activities;

- At present, out of the thirty employees in Abuja, five are resident in Suleja, Niger State.

Required:

(a) Explain briefly the following:

i. Capital Gains Tax

ii. Withholding Tax

iii. Double Taxation Treaty

iv. Multiple Taxation (12 Marks)

(b) Discuss measures put in place by the government to reduce cases of multiple taxation. (6 Marks)

(c) State the arms of government empowered by the Constitution to legislate on tax matters. (6 Marks)

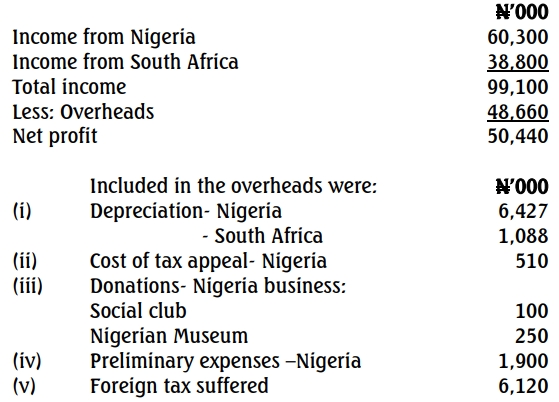

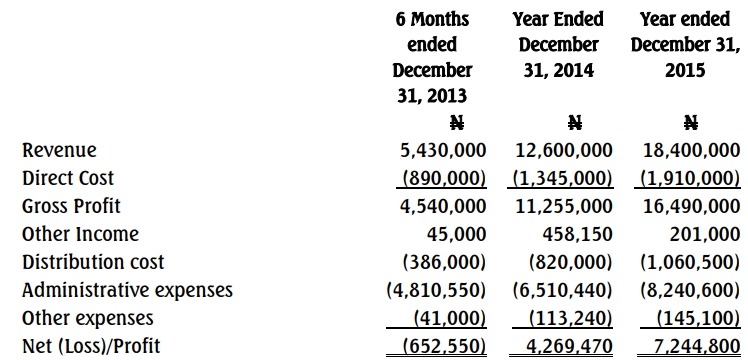

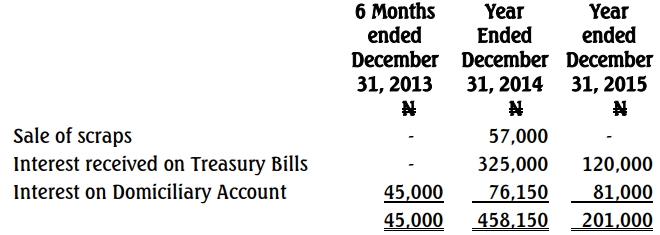

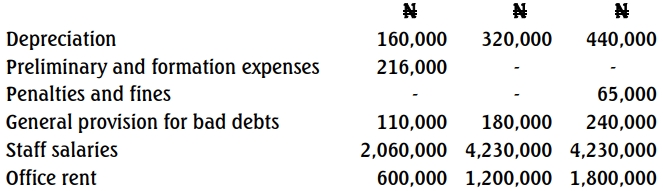

(d) Determine the Companies Income Tax due from Rex Pharmaceuticals Limited for the year ended December 31, 2015. (6 Marks)