- 20 Marks

PM – Nov 2019 – L2 – Q5 – Pricing Decisions

Evaluate profitability and ROI under different transfer pricing schemes between Division A and B of Ezeabunafo Nigeria Ltd.

Question

Ezeabunafo Nigeria Limited, an aluminium company, has two divisions, A and B.

Division A manufactures a single uniform product, which is partly sold in the

external market and partly transferred to division B where it forms the major sub –

assembly for that division‟s product.

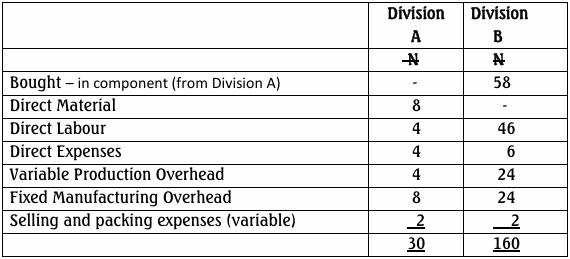

The unit cost for each division‟s product is as shown here under:

Past data shows that average of 10,000 units of its products are sold on the

external market each year by Division A at the standard price of N60.

In addition to the external sales, 5,000 units are transferred annually to Division B

at a transfer price of N58 per unit (as above). The transfer price is derived by

deducting variable selling and packaging expenses from the external price since

these expenses are not incurred for internal transfers.

Division B‟s manager disagrees with the basis used to set the transfer price. He

contends that the transfer price should be made at variable cost plus an agreed

(minimal) mark up. It is his view that under the present set-up, his division is

taking output that Division A would be unable to sell at the price of N60.

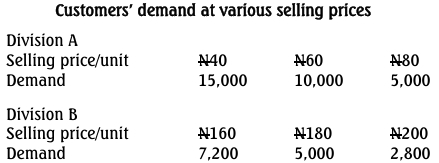

A study commissioned by the Marketing Director consequent on this disagreement

shows the following:

Division B‟s manager maintains that the study has buttressed his case and calls for

a transfer price of N24 which he points out, would give Division B a reasonable

contribution to its fixed overheads as well as enable B to earn a reasonable profit

which also leads to an enhanced company-wide output and profit performance.

Required:

a. Calculate the contribution at alternative selling prices shown in the study for Division A and identify the price that maximizes Division A’s profit. (6 Marks)

b. Calculate the contribution at alternative prices for Division B and determine if the current selling price of N180 maximizes the firm’s overall profit. (5 Marks)

c. Assuming a transfer price equal to Division A’s variable costs, calculate the contribution for Division B at alternative prices. (3 Marks)

d. Calculate the contribution per unit and comment on how the whole firm is affected under this situation. (3 Marks)

e. Evaluate the effect on company profits if Division B’s manager’s suggestion of a N24 transfer price is adopted. (3 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Divisional Management, Profit Contribution, ROI, Transfer Pricing

- Level: Level 2

- Topic: Pricing Decisions

- Series: NOV 2019