- 15 Marks

CR – May 2016 – L3 – Q4a – Business valuation

Compute the value of ordinary shares using three valuation methods for a company preparing for listing, based on given financial statements and additional information.

Question

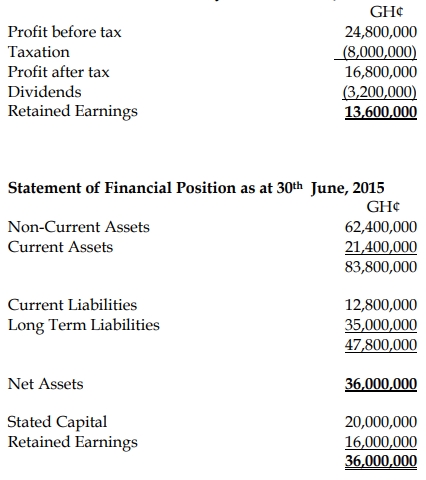

In 2015, the shareholders of Depot Ltd decided to sell their equity stake in the company. The company is not listed and the new shareholders plan to prepare the company for listing once the acquisition was completed. The summarized financial statements of Depot Ltd for the year ended 30th June, 2015 are stated below:

Statement of Income for the year ended 30th June, 2015

The following additional information is provided;

- The discounted present value of future cash payments in respect of the long term loan is GH¢48,800,000.

- The stated capital of Depot Ltd is made up of 25,000,000 ordinary shares of no par value.

- Current Assets include inventory of GH¢6,600,000 representing goods received from a major supplier on “not for sale but display only” basis.

- The fair value of the tangible non-current assets was GH¢116,000,000.

- The profit for the current year includes VAT of 17.5% on turnover of GH¢8,500,000 being invoice amount sold to a customer.

- The discount rate of Depot Ltd is 10% per annum.

- Warehouse Ltd, a major competitor of Depot Ltd is listed with a P/E ratio of 9 and dividend yield of 5.2.

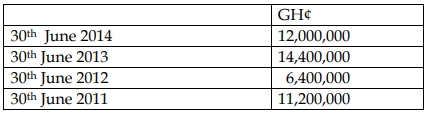

- Profits after tax over the 4 years were as follows;

Required:

Compute the value to be placed on the ordinary shares using three methods of valuation and advise the Directors accordingly.

Find Related Questions by Tags, levels, etc.