- 1 Marks

QTB – Nov 2015 – L1 – SA – Q18 – Mathematics of Business Finance

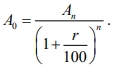

This question identifies the term used to describe the process of calculating present value from future value.

Find Related Questions by Tags, levels, etc.

- Tags: Discounting, Present Value, Time value of money

- Level: Level 1

- Topic: Mathematics of Business Finance

- Series: NOV 2015