- 30 Marks

FM – May 2017 – L3 – Q1 – Cost of Capital

Calculate project-specific cost of capital and assess project feasibility.

Question

K Plc., a listed company based in Warri, Delta state, has been involved in producing boats (but excluding the engines). The company is now considering diversifying into the production of a major component of outboard engine. For this purpose, the company has recently purchased the patent rights for ₦15 million to produce the component.

K Plc. has spent ₦20 million developing prototypes of the component and undertaking market studies. The research studies came to the conclusion that the component will have significant commercial potential for a period of five years, after which newer components would come into the market and the sales revenue from the component would virtually fall to zero. The research studies have also found that in the first two years (the development phase), there will be considerable training and development costs and fewer components will be produced and sold. However, sales revenue is expected to grow rapidly in the following three years (the commercial phase).

It is estimated that in the first year, the selling price would be ₦2,000 per component, the variable costs would be ₦800 per component, and the total direct fixed costs would be ₦6,000,000. Thereafter, while the selling price is expected to increase by 8% per year, the variable and fixed costs are expected to increase by 5% per year for the next four years. Training and development costs are expected to be 120% of variable costs in the first year, 40% in the second year, and 10% in each of the following three years.

The estimated average number of outboard engine components produced and sold per year is given below:

| Year | Units produced and sold |

|---|---|

| 1 | 15,000 |

| 2 | 40,000 |

| 3 | 100,000 |

| 4 | 120,000 |

| 5 | 190,000 |

Machinery, costing ₦480,000,000, will need to be installed prior to the commencement of component production. K Plc. has enough space in its factory to manufacture the components and therefore will incur no additional rental costs. Tax-allowable depreciation is available on the machinery at 10% on a straight-line basis. The machinery is expected to be sold for ₦160,000,000 at the end of year 5. The company makes sufficient profits from its other activities to take advantage of any tax loss relief available from this project.

Initially, K Plc. will require additional working capital for the project of 20% of the first year’s sales revenue. Thereafter, every ₦1 increase in sales revenue will require a 10% increase in working capital.

Although this would be a major undertaking for the company, it is confident that it can raise the finance required for the machinery and the first year’s working capital. The financing will be through a mixture of a rights issue and a bank loan, in the same proportion as the market values of current equity and debt capital. Any annual increase in working capital after the first year will be financed by internally generated funds.

Marine Engineers (ME) Plc. is a listed company involved in the manufacture of outboard engine components for many years.

Additional data

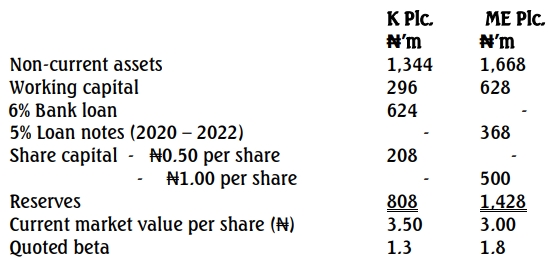

Extracts from Statement of Financial Position:

The loan notes of ME Plc. are quoted at ₦102 per ₦100

Other Data:

- Tax rate applicable to K Plc. and ME Plc.: 20%

- Estimated risk-free rate of return: 3%

- Historic equity market risk premium: 6%

Required:

a. Given the information on ME Plc. and the project financing mix, including any other relevant information, calculate the project-specific cost of capital. (5 Marks)

b. Assess whether K Plc. should undertake the project of developing and commercializing the major component of outboard engine, assuming a discount rate of 12% as being applicable for the assessment, irrespective of your calculations in (a) above. (22 Marks)

c. State any THREE relevant assumptions made for your calculations in (a) and (b) above. (3 Marks)

(Total 30 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Assumptions, Discount Rates, NPV Analysis, Project Financing

- Level: Level 3

- Topic: Cost of capital