Aghobe Air owns a single aircraft which operates between Lagos and Kano. The normal flight schedule is that flights leave Lagos on Mondays and Thursdays and depart from Kano on Wednesdays and Saturdays. Aghobe Air cannot offer any more flights between Lagos and Kano. The only seat available on the aircraft is economy class.

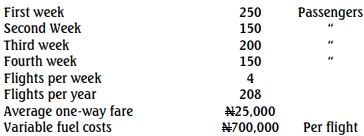

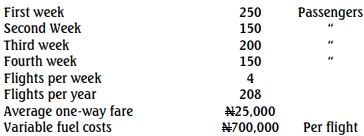

The following information is available: Seating capacity of the aircraft is 360 passengers. Weekly average number of passengers per flight is as follows:

Additional information:

(i) Food and beverages service cost N1,000 per passenger but at no charge to the passengers;

(ii) Commission to travel agents paid by Aghobe Air (All tickets are booked by travel agents) is 8% of fare;

(iii) Fixed annual leased costs allocated to each flight is N2,650,000 per flight;

(iv) Fixed ground services (maintenance, check in baggage handling, etc.) cost allocated to each flight N350,000 per flight;

(v) Fixed flight crew salaries allocated to each flight is N200,000 per flight; and

(vi) Fuel cost is unaffected by the actual number of passengers on the flight.

Required:

a. Determine the net operating income made by Aghobe Air on each one way flight between Lagos and Kano. (5 Marks)

b. The market research unit of Aghobe Air indicates that lowering the average one way fare to N24,000 will increase the average number of passengers per flight to 212. Should Aghobe Air lower its fare? (5 Marks)

c. A tourist group known as Sea Bird Tour Operator approaches Aghobe Air on the possibility of chartering the aircraft twice each month from Lagos to Kano and back from Kano to Lagos. If Aghobe Air accepts the offer, it will only offer 184 flights in each year. Other terms of the offer include:

- For each one way flight, Sea Bird Tour Operator will pay Aghobe Air N3,750,000 which covers cost of charter for one way, use of flight crew and ground service staff. Sea Bird Tour operator will pay for fuel costs, food and beverages.

Should Aghobe Air accept the offer from Sea Bird Tour Operator? (5 Marks)

d. What factors should be taken into consideration in taking the decision in (c) above? (5 Marks)