Eko Plc. (Eko) is a listed company in the food retailing sector and has large stores in all major cities in the country. Eko’s board is considering diversifying by opening holiday travel shops in all of its stores.

At a recent board meeting, the directors discussed how the holiday travel shops project (the project) should be appraised. The sales director insisted that Eko’s current weighted average cost of capital (WACC) should be used to evaluate the project, as the majority of its operations will still be in food retailing. The finance director disagreed, stating that the existing cost of equity does not account for the systematic risk of new projects and that the company’s overall WACC would change as a result of the project’s acceptance. The board was also concerned about the market’s reaction to its diversification plans. Another board meeting was scheduled, at which Eko’s advisors would be asked to make a presentation on the project.

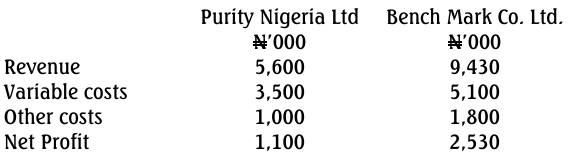

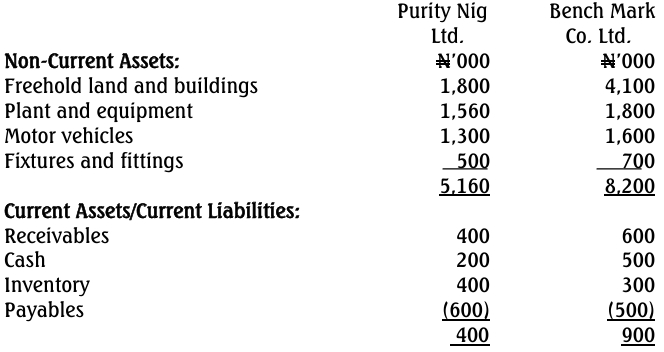

You work for Eko’s advisors and have been asked to prepare information for the presentation. You have established the following:

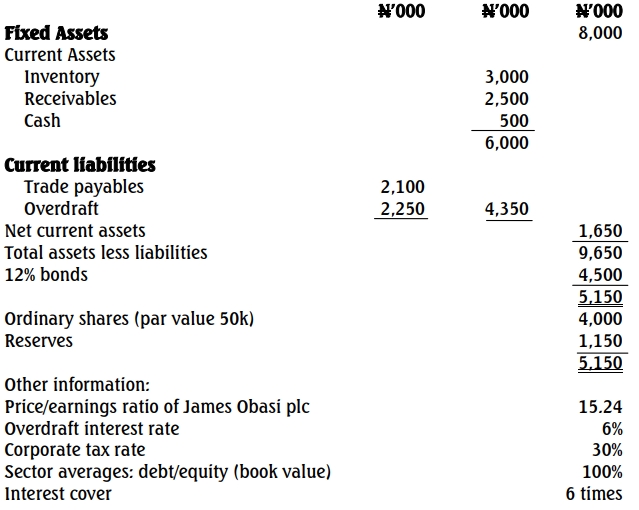

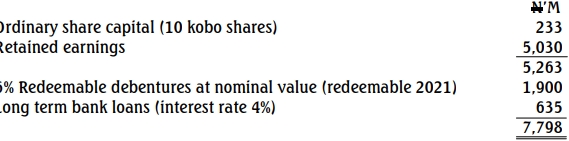

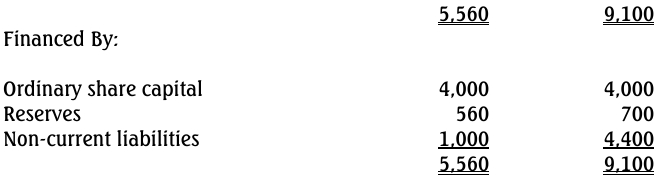

Eko intends to raise the capital required for the project in such a way as to leave its existing debt-to-equity ratio (by market value) unchanged following the diversification. Extracts from Eko’s most recent management accounts are shown below:

Statement of financial position as at May 31, 2017

On May 31, 2017, Eko’s ordinary shares had a market value of 276 kobo (ex-div) and an equity beta of 0.60. For the year ended May 31, 2017, the dividend yield was 4.2%, and the earnings per share were 25 kobo. The return on the market is expected to be 8% p.a, and the risk-free rate is 2% p.a.

Eko’s debentures had a market value of N108 (ex-interest) per N100 nominal value on May 31, 2017, and they are redeemable at par on May 31, 2021.

Companies operating solely in the holiday travel industry have an average equity beta of 1.40 and an average debt-to-equity ratio (by market value) of 3:5. It is estimated that if the project goes ahead, the overall equity beta of Eko will be made up of 90% food retailing and 10% holiday travel shops.

Assume that the income tax rate will be 20% p.a. for the foreseeable future.

Required:

a. Ignoring the project, calculate the current WACC of Eko using:

i. The Capital Asset Pricing Model (CAPM) (8 Marks)

ii. The Gordon Growth Model (6 Marks)

b. Use the CAPM to calculate the cost of equity that should be included in a WACC suitable for appraising the project and explain your reason. (5 Marks)

c. By calculating an overall equity beta and using the CAPM, estimate the overall WACC of Eko assuming that the project goes ahead and comment on the implications of a permanent change in the overall WACC. (5 Marks)

d. Advise whether Eko should diversify its operations and how the stock market might react to the proposed project. (3 Marks)

e. Identify the appropriate project appraisal methodology that should be used when a project’s financing results in a major increase in a company’s market gearing ratio, and using the data relating to Eko, calculate the project discount rate that should be used in this circumstance. (3 Marks)