- 10 Marks

AFM – May 2019 – L3 – Q5a – The role of the treasury function in multinationals

Calculate intragroup currency transfers through netting and discuss the pros and cons of using currency options versus futures for hedging net exposures.

Question

Edi Ltd, based in Accra, Ghana, is a multinational company with two wholly-owned subsidiaries: Gil Plc based in Nigeria and Zep Ltd based in South Africa. Until recently, the Edi group has been doing well, returning a stable level of dividends to its shareholders. The financial performance of the Edi group has dipped in the past two years. In the last quarter of last year, the directors approved the establishment of a central treasury department based at the group’s headquarters in Accra. It is believed that the central treasury function will help boost effectiveness and efficiency in the group’s liquidity management, currency risk management, dividend remittances, and borrowing.

Intragroup Currency Transfers:

There are a lot of intragroup credit transactions that are often settled independently between the parties involved. This year, the treasury department has been tasked to manage the settlement of intragroup indebtedness through netting to reduce the volume of currency transactions. It has been agreed that all settlements will be made in the Ghanaian cedi at the prevailing spot mid-market exchange rate.

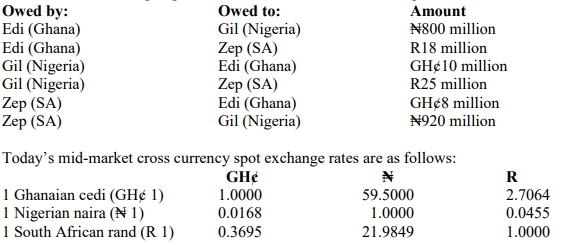

Below is a list of intragroup indebtedness at the end of the first quarter to be settled today:

Required:

i) Suppose the currency netting is implemented. Calculate the intragroup company currency transfers that will be required for settlement by each member of the Edi group.

(6 marks)

ii) Suppose the treasury department is recommending the use of currency futures to hedge net currency exposures. Discuss the advantages and disadvantages of the Edi group using currency options instead of currency futures in hedging net currency exposures.

Find Related Questions by Tags, levels, etc.