- 1 Marks

QTB – MAY 2016 – L1 – SA – Q6 – Mathematics

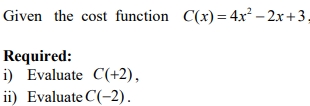

Calculate break-even quantity given revenue and cost functions

Find Related Questions by Tags, levels, etc.

- Tags: Break-even Analysis, Cost Function, Revenue Function

- Level: Level 1

- Topic: Mathematics

- Series: MAY 2016