- 15 Marks

FA – May 2014 – L1 – SA – Q2 – Correction of Errors

Suspense account entries and explanation of the effects of errors on accounts and profit.

Question

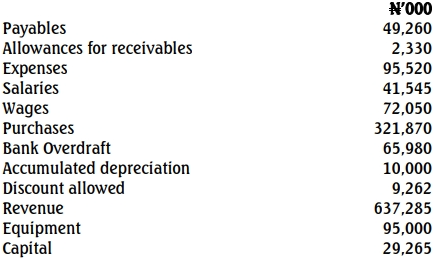

The bookkeeper of Jafola Ltd, having been unable to agree the trial balance as at 31 January 2013, raised a Suspense Account in which he entered the difference. Consequently, he prepared a draft Statement of Financial Position to reflect the amount in the Suspense Account.

On investigation, the following errors were discovered:

i. The addition of the analysis column in the tabular purchase journal posted to goods purchased for resale account was found to be under-cast by N15,000, though the addition of the total column was correct.

ii. Goods bought from a supplier amounting to N5,250 had been posted to the credit of his account as N55,000.

iii. A dishonoured bill of exchange receivable for N200,000 returned by the Company’s bank had been credited to the bank account and debited to bills receivable account.

iv. An item of N10,500 entered in the sales returns book was posted to the debit of the customer who returned the goods.

v. Sundry items of plant sold amounting to N300,000 were posted to the sales day book, the total of which had been posted to the credit of the sales account.

vi. A sum of N60,000 owed by a customer was omitted from the schedule of sundry receivables.

vii. Discounts amounting to N2,250 allowed to a customer were duly entered in his account but not posted to the discounts allowed account.

viii. An amount of N45,000 being tenement rates paid in advance in the previous year was not brought forward as a balance on the tenement rates account.

You are required to:

a. Show the Suspense Account as raised by the bookkeeper with the adjusting entries. (5 Marks)

b. Explain the effect the above errors would have on the profit shown in the accounts (if not rectified) and on the total accounts. Assume the purchase and sales ledgers to be self-balancing. (10 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Accounting Adjustments, Correction of Errors, Suspense account

- Level: Level 1

- Topic: Correction of errors

- Series: MAY 2014