- 12 Marks

CR – Nov 2021 – L3 – Q2b – Earnings Per Share (IAS 33)

Calculate basic and diluted earnings per share (EPS) from Nsukka Plc’s consolidated financial statements.

Question

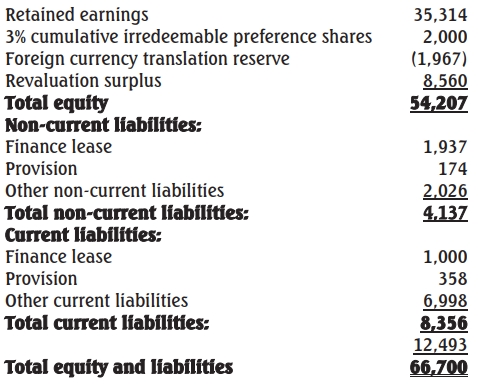

b. The following financial information relates to Nsukka Group for the year ended June 30, 2021.

Nsukka Group Consolidated Statement of Financial Position as at June 30, 2021

Additional Information:

- Nsukka PLC reports a profit after tax, after adjusting for all current year accounting issues, of N1,850,000 and an effective tax rate of 20%.

- For the first time, Nsukka PLC issued 1,000,000 ordinary shares and granted options for 400,000 shares on July 1, 2020. The exercise price was the market price of N1.50 per share at the grant date. Options vest on July 1, 2020, and expire on June 30, 2022. The average market price of shares in Nsukka Plc during the year ended June 30, 2022, was N1.834.

- A rights issue of 1 for every 20 shares was made on May 31, 2021, at a price of N1.30 per share. The market price at this date was N1.60, and the average price for the year to June 30, 2021, was N1.65.

- Nsukka PLC has N1,000,000 of 6% convertible loans included in other non-current liabilities. These were in issue throughout the year and may be converted into 100,000 ordinary shares. No loans were converted during the year. There are no dividends in arrears on the 3% preference shares.

Required:

Evaluate basic and diluted earnings per share from the consolidated statement of financial position as at June 30, 2021, for Nsukka Plc.

(12 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Basic EPS, Convertible Loans, Diluted EPS, Financial Ratios, Share Options

- Level: Level 3

- Topic: Earnings Per Share (IAS 33)