- 30 Marks

FR – May 2024 – L2 – SA – Q1 – Statement of Cash Flows (IAS 7)

Preparation of financial statements for Adama PLC, including profit or loss, changes in equity, and memo on EPS and ROCE.

Question

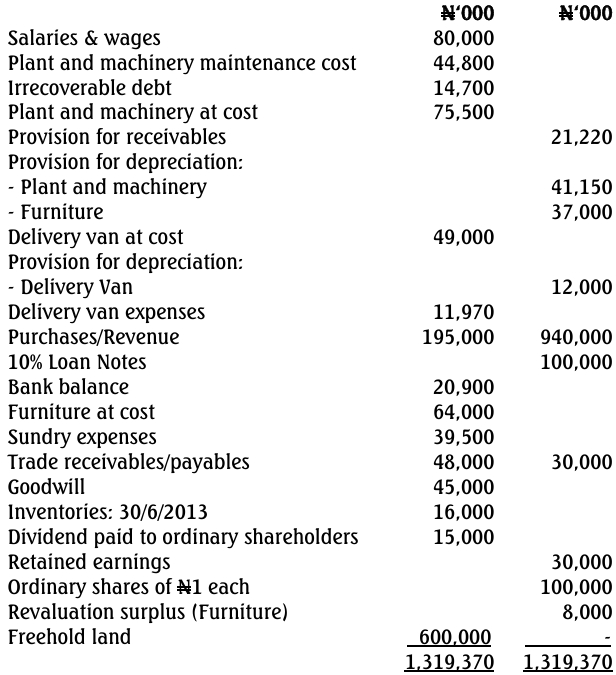

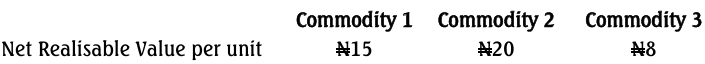

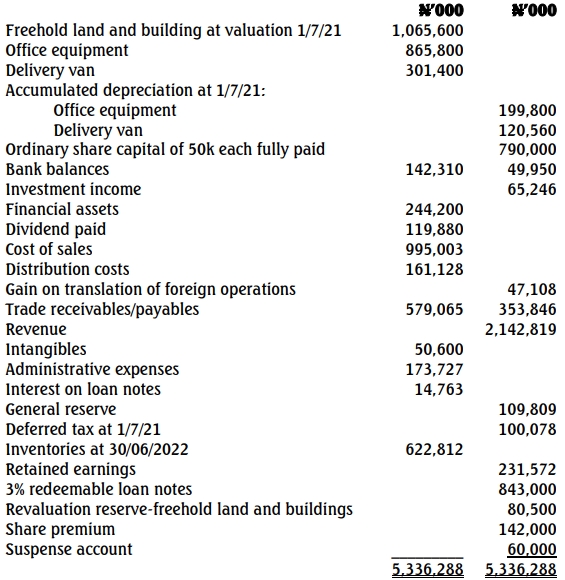

a. The following trial balance was extracted from the books of Adama Plc as at June 30, 2022:

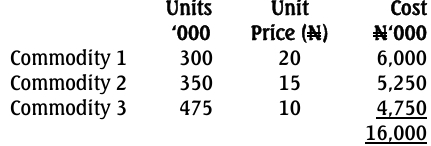

Additional information:

- The value of the freehold land and buildings includes a land element of N266,800,000, and the estimated remaining life of the buildings at July 1, 2021, was 25 years. Depreciation on buildings is charged 65% to cost of sales and 35% to administrative expenses.

- The revenue includes N69,250,000 for an item of office equipment disposed of on November 30, 2021. The equipment had a carrying value of N46,060,000 at the date of sale. The equipment cost N75,000,000 when acquired three years ago.

- Included in the cost of sales is N82,600,000 incurred in the manufacture of new office equipment, which was put to use by Adama PLC on February 1, 2022.

- All office equipment is depreciated at 15% per annum using the reducing balance method, charged to cost of sales. Depreciation on all motor vehicles is at 20% per annum on a straight-line basis and charged to distribution costs. Depreciation is charged in full in the year of acquisition and no charge in the year of disposal.

- Following the conclusion of winding-up proceedings for one of Adama PLC’s customers, it was resolved to write off the sum of N26,450,000 due from the customer and to make an allowance for doubtful receivables of 2½% on the continuing trade receivables.

- The financial assets are equity instruments held at fair value through profit or loss, and they suffered an impairment loss of N12,700,000 at the year-end.

- The 3% redeemable loan notes were issued on October 1, 2021, under terms that provided for a large premium on redemption in 2025. These terms were interpreted by the finance director to mean an effective interest rate of 6½% per annum.

- The income tax expense for the year ended June 30, 2022, is estimated at N143,552,000, while the deferred tax payable for the same period is N12,520,000. There was an over-provision of N25,664,000 in respect of income tax for the previous trading year.

- The suspense account balance represents the corresponding credit entry for shares issued at a premium of 15 kobo per share, arising from the issue of 400,000 ordinary shares made during the year.

- The directors recommended a 20 kobo final dividend per ordinary share for the year and a transfer of N38,900,000 to the general reserve.

Required: Prepare for Adama PLC the following financial statements:

- Statement of profit or loss and other comprehensive income for the year ended June 30, 2022. (10 Marks)

- Statement of changes in equity for the same period. (4 Marks)

- Statement of financial position as of June 30, 2022. (10 Marks)

b. Some new trainee accountants in your organization discussed Earnings Per Share (EPS) and Return on Capital Employed (ROCE) as the best ratios for analyzing an entity’s financial performance. The finance director has requested a memo explaining these ratios and highlighting their limitations.

Required:

Prepare a memo to the finance director explaining the EPS and ROCE ratios and their limitations. (6 Marks)

Find Related Questions by Tags, levels, etc.