- 20 Marks

PM – May 2024 – L2 – SB – Q4 – Environmental and Social Performance Management

Forecast sales with seasonality adjustments and regression analysis to produce cash forecasts.

Question

Some time ago Robert launched a new product. At first, sales were good, but now the figures are causing concern. Robert wants a more accurate sales forecast to produce detailed cash forecasts.

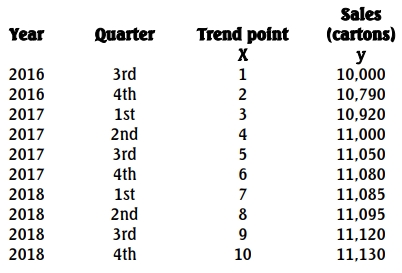

Since there is some seasonality present in the raw data, the series for sales shown below represents the underlying trend based on an averaging process:

On average, quarters 1 and 3 are 5% and 6% respectively above trend, while quarters 2 and 4 are respectively 2% and 9% below trend.

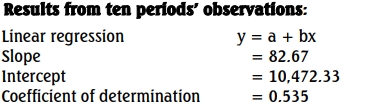

Some preliminary calculations on the above ten observations have been carried out and the results are summarized below:

Required:

a. Forecast the sales for the next two years, adjusting for seasonality. (12 Marks)

b. Discuss the importance of seasonality adjustments in sales forecasting. (4 Marks)

c. Explain how Robert could use the sales forecasts to produce detailed cash forecasts. (4 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Cash Forecasting, Regression, Sales Forecasting, Seasonality, Trend Analysis

- Level: Level 2

- Topic: Environmental and Social Performance Management

- Series: MAY 2024