- 16 Marks

FR – May 2019 – L2 – Q2a and Q2b – Presentation of Financial Statements (IAS 1)

Prepare the statement of cash flows for Babafrayo Nig. Ltd. using the indirect method and calculate the net cash flow from operating activities using the direct method.

Question

Babafrayo Nig. Ltd. is a company located in Lagos and is engaged in the hotel and tourism business. The financial statements of the company are as follows:

Statement of Profit or Loss and Other Comprehensive Income for the Year Ended 31 December 2018:

| Description | ₦’000 |

|---|---|

| Revenue | 994,500 |

| Cost of sales | (884,000) |

| Gross profit | 110,500 |

| Admin expenses | (21,250) |

| Distribution cost | (44,200) |

| Finance costs | (4,250) |

| Profit before taxation | 40,800 |

| Income tax expense | (5,100) |

| Profit for the year | 35,700 |

| Other comprehensive income | |

| Gains on property revaluation | 17,000 |

| Total comprehensive income | 52,700 |

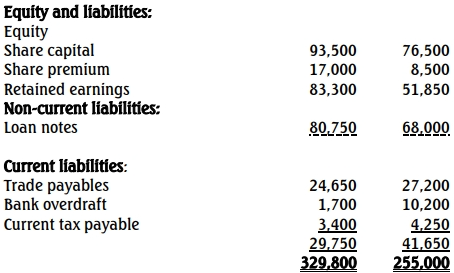

Statement of Financial Position as at 31 December 2018:

| Description | 2018 N’000 | 2017 N’000 |

|---|---|---|

| Non-current assets: | ||

| Property, plant & equipment | 242,250 | 174,250 |

| Total non-current assets | 242,250 | 174,250 |

| Current assets: | ||

| Inventories | 49,300 | 51,000 |

| Trade receivables | 35,700 | 25,500 |

| Cash and cash equivalent | 2,550 | 4,250 |

| Total current assets | 87,550 | 80,750 |

| Total assets | 329,800 | 255,000 |

Additional information:

(i) Property, plant, and equipment with a carrying value of ₦23,800,000 was sold during the year ended 31 December 2018 for ₦24,650,000. The asset had originally cost ₦38,250,000.

(ii) Depreciation on property, plant, and equipment for the year 2018 amounted to ₦34,000,000.

(iii) Dividend paid during the year 2018 amounted to ₦4,250,000 and is reported in the statement of changes in equity for the year.

(a) Prepare the statement of cash flows for the year ended 31 December 2018 in accordance with IAS 7 using the indirect method.

(12 Marks)

(b) Prepare net cash flows from operating activities only using the direct method.

(6 Marks)

Find Related Questions by Tags, levels, etc.