- 10 Marks

BCL – Nov 2024 – L1 – Q3b – Financial Assistance for Share Purchase

Conditions under which a company may provide financial assistance for share purchase.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

LL Plc. is a large engineering company. Its ordinary shares are quoted on the Stock Exchange.

LL Plc.’s Board is concerned that the company’s gearing level is too high and that this is having a detrimental impact on its market capitalisation. As a result, the Board is considering a restructuring of LL Plc.’s long-term funds, details of which are shown here as at 28 February, 2017:

| Funding Source | Total Par Value (₦m) | Market Value |

|---|---|---|

| Ordinary Share Capital (50k) | 67.5 | ₦2.65/share ex-div |

| 7% Preference Share Capital (₦1) | 60.0 | ₦1.44/share ex-div |

| 4% Redeemable Debentures (₦100) | 45.0 | 90% ex-int |

The debentures are redeemable in 2022. LL Plc.’s earnings for the year to 28 February, 2017 were ₦32.4 million and are expected to remain at this level for the foreseeable future. Retained earnings, as at 28 February, 2017 were ₦73.2 million.

The Board is considering a 1 for 9 rights issue of ordinary shares, and this additional funding would be used to redeem 60% of LL Plc.’s redeemable debentures at par. However, some of LL Plc.’s directors are concerned that this issue of extra ordinary shares will cause the company’s ordinary share price and its earnings per share (EPS) to fall by an excessive amount, to the detriment of LL Plc.’s shareholders. Accordingly, they are arguing that the rights issue should be designed so that the EPS is not diluted by more than 5%.

The Directors wish to assume that the income tax rate will be 21% for the foreseeable future and the tax will be payable in the same year as the cash flows to which it relates.

Required:

a. i. Calculate LL Plc.’s gearing ratio using both book and market values. (5 Marks)

ii. Discuss, with reference to relevant theories, why LL Plc.’s Board might have concerns over the level of gearing and its impact on LL Plc.’s market capitalisation. (6 Marks)

b. Assuming that a 1 for 9 rights issue goes ahead, calculate the theoretical ex-rights price of LL Plc.’s ordinary share and the value of a right. (3 Marks)

c. Discuss the Directors’ view that the rights issue will cause the share price and the EPS to fall by an excessive amount, to the detriment of LL Plc.’s ordinary shareholders. Your discussion should be supported by relevant calculations. (6 Marks)

Find Related Questions by Tags, levels, etc.

a. Past surveys revealed that one of the most important financial indicators in evaluating ordinary shares is the expected changes in earnings per share (EPS). Corporate earnings are a key component of these financial indicators, and, as far as investors are concerned, the quality of earnings is important in measuring a company’s prospects. The quality of earnings can be affected by several factors, which are at the discretion of management. A simple or complex capital structure also plays a vital role in the assessment of earnings quality and EPS.

Required:

i. What does “quality of earnings” connote, and how can it be assessed?

(5 Marks)

ii. What are the factors that can affect the quality of earnings of an organisation?

(3 Marks)

Find Related Questions by Tags, levels, etc.

Yemi John Plc. (YJ) is planning to raise N30 million in new finance for a major expansion of its existing business and is considering a rights issue, a placing, or an issue of bonds. The corporate objectives of YJ, as stated in its annual report, are to maximize the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on YJ is as follows:

| Year | 2017 | 2016 | 2015 | 2014 |

|---|---|---|---|---|

| Turnover (Nm) | 28.0 | 24.0 | 19.1 | 16.8 |

| Earnings before interest and tax (EBIT) (Nm) | 9.8 | 8.5 | 7.5 | 6.8 |

| Profit after tax (PAT) (Nm) | 5.5 | 4.7 | 4.1 | 3.6 |

| Dividends (Nm) | 2.2 | 1.9 | 1.6 | 1.6 |

| Ordinary shares (Nm) | 5.5 | 5.5 | 5.5 | 5.5 |

| Reserves (Nm) | 13.7 | 10.4 | 7.6 | 5.1 |

| 8% Bonds, redeemable 2024 (Nm) | 20 | 20 | 20 | 20 |

| Share price (N) | 8.64 | 5.74 | 3.35 | 2.67 |

The par value of the shares of YJ is N1.00 per share. The general level of inflation has averaged 4% per year in the period under consideration. The bonds of YJ are currently trading at their par value of N100. The values for the business sector of YJ are as follows:

EBIT/closing total capital employed

Required:

a. Evaluate the financial performance of YJ, analyzing and discussing the extent to which the company has achieved its stated objectives of:

i. maximizing the wealth of its shareholders; and

ii. achieving continuous growth in earnings per share. (13 Marks)

Note: Up to 8 marks are available for financial analysis.

b. Analyze and discuss the relative merits of a rights issue, a placing, and an issue of bonds as ways of raising finance for the expansion. (7 Marks)

Find Related Questions by Tags, levels, etc.

What will be the balance on the share premium account after the rights issue?

| Item | N’000 |

|---|---|

| Ordinary share capital: 200,000 shares of 50k each | 100 |

| Premium account | 150 |

The company made a rights issue of 1 for 5 at N1.50, and the rights issue was fully subscribed.

A. N90,000

B. N140,000

C. N150,000

D. N190,000

E. N200,000

Find Related Questions by Tags, levels, etc.

The capital structure of Baba Oba Limited is shown below:

| Item | N’000 |

|---|---|

| Ordinary share capital: 200,000 shares of 50k each | 100 |

| Premium account | 150 |

The company made a rights issue of 1 for 5 at N1.50, and the rights issue was fully subscribed.

What is the amount of the rights issue credited to share capital?

A. N20,000

B. N40,000

C. N50,000

D. N70,000

E. N100,000

Find Related Questions by Tags, levels, etc.

A firm has recently collected the following data in respect of its capital structure, expected earnings per share, and required rate of return.

| Debt Ratio % | Expected Earnings Per Share (N) | Required Rate of Return (%) |

|---|---|---|

| 0 | 3.10 | 14 |

| 10 | 3.80 | 16 |

| 20 | 4.60 | 17 |

| 30 | 5.25 | 19 |

| 40 | 5.70 | 20 |

| 50 | 5.00 | 22 |

| 60 | 4.50 | 24 |

You are required to:

a. Compute the estimated share values. (10 Marks)

b. Determine the optimal capital structure based on the maximization of expected earnings per share and the maximization of share values. (5 Marks)

c. Which capital structure criterion would you recommend and why? (5 Marks)

(Total: 20 Marks)

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

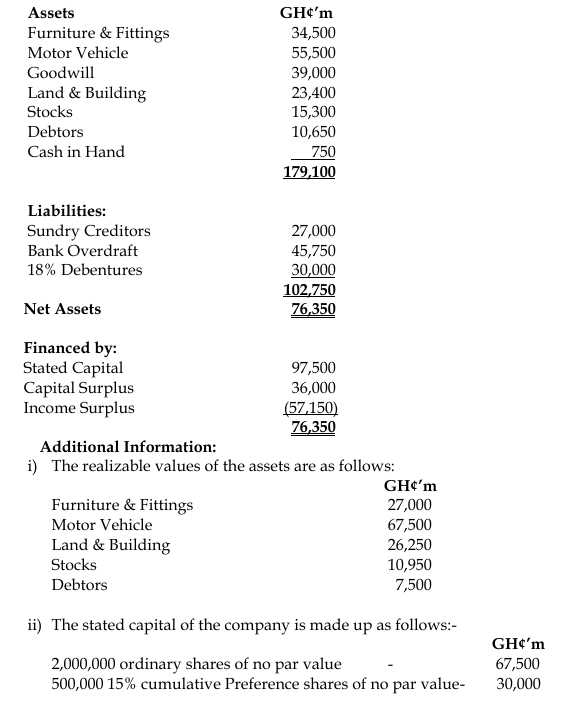

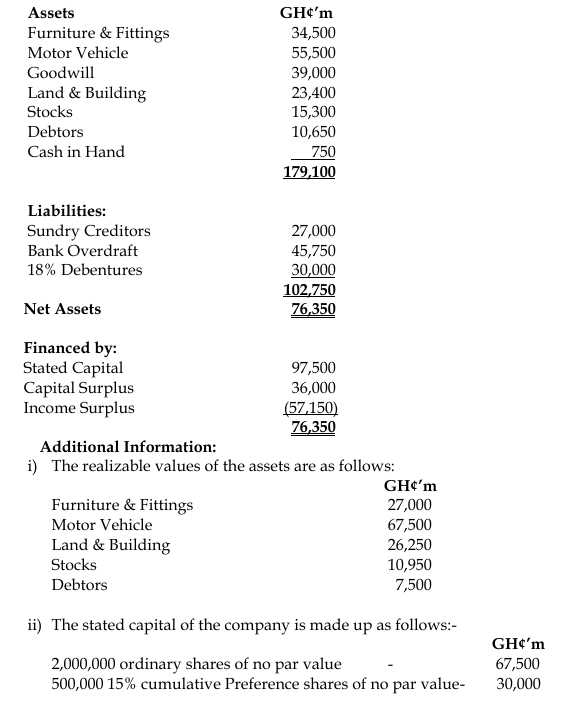

Additional Information:

Required:

a) Calculate the amount available if Crave Cottage Industry Limited is liquidated and its distribution.

(7 marks)

b) Calculate the maximum possible loss of Crave Cottage Industry Limited and its allocation to Preference Share Capital and Ordinary Share Capital. (6 marks)

c) Calculate the Bank/Cash balance of Crave Cottage Industry Limited after the reorganization. (2 marks)

d) Calculate the new stated capital for the company after the reorganization. (2 marks)

e) Prepare a Statement of Financial Position of Crave Cottage Industry Limited showing the position immediately after the scheme has been put in place.

(3 marks)

Find Related Questions by Tags, levels, etc.

c) Ten years ago, Brown Limited issued GH¢2.5 million of 6% discounted debentures at GH¢98 per 100 nominal. The debentures are redeemable in 5 years from now at GH¢2 premium over nominal value. They are currently quoted at GH¢80 per debenture ex-interest. Brown Limited pays corporate tax at the rate of 30%.

You are required to calculate the cost of debt after tax.

(4 marks)

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

LL Plc. is a large engineering company. Its ordinary shares are quoted on the Stock Exchange.

LL Plc.’s Board is concerned that the company’s gearing level is too high and that this is having a detrimental impact on its market capitalisation. As a result, the Board is considering a restructuring of LL Plc.’s long-term funds, details of which are shown here as at 28 February, 2017:

| Funding Source | Total Par Value (₦m) | Market Value |

|---|---|---|

| Ordinary Share Capital (50k) | 67.5 | ₦2.65/share ex-div |

| 7% Preference Share Capital (₦1) | 60.0 | ₦1.44/share ex-div |

| 4% Redeemable Debentures (₦100) | 45.0 | 90% ex-int |

The debentures are redeemable in 2022. LL Plc.’s earnings for the year to 28 February, 2017 were ₦32.4 million and are expected to remain at this level for the foreseeable future. Retained earnings, as at 28 February, 2017 were ₦73.2 million.

The Board is considering a 1 for 9 rights issue of ordinary shares, and this additional funding would be used to redeem 60% of LL Plc.’s redeemable debentures at par. However, some of LL Plc.’s directors are concerned that this issue of extra ordinary shares will cause the company’s ordinary share price and its earnings per share (EPS) to fall by an excessive amount, to the detriment of LL Plc.’s shareholders. Accordingly, they are arguing that the rights issue should be designed so that the EPS is not diluted by more than 5%.

The Directors wish to assume that the income tax rate will be 21% for the foreseeable future and the tax will be payable in the same year as the cash flows to which it relates.

Required:

a. i. Calculate LL Plc.’s gearing ratio using both book and market values. (5 Marks)

ii. Discuss, with reference to relevant theories, why LL Plc.’s Board might have concerns over the level of gearing and its impact on LL Plc.’s market capitalisation. (6 Marks)

b. Assuming that a 1 for 9 rights issue goes ahead, calculate the theoretical ex-rights price of LL Plc.’s ordinary share and the value of a right. (3 Marks)

c. Discuss the Directors’ view that the rights issue will cause the share price and the EPS to fall by an excessive amount, to the detriment of LL Plc.’s ordinary shareholders. Your discussion should be supported by relevant calculations. (6 Marks)

Find Related Questions by Tags, levels, etc.

a. Past surveys revealed that one of the most important financial indicators in evaluating ordinary shares is the expected changes in earnings per share (EPS). Corporate earnings are a key component of these financial indicators, and, as far as investors are concerned, the quality of earnings is important in measuring a company’s prospects. The quality of earnings can be affected by several factors, which are at the discretion of management. A simple or complex capital structure also plays a vital role in the assessment of earnings quality and EPS.

Required:

i. What does “quality of earnings” connote, and how can it be assessed?

(5 Marks)

ii. What are the factors that can affect the quality of earnings of an organisation?

(3 Marks)

Find Related Questions by Tags, levels, etc.

Yemi John Plc. (YJ) is planning to raise N30 million in new finance for a major expansion of its existing business and is considering a rights issue, a placing, or an issue of bonds. The corporate objectives of YJ, as stated in its annual report, are to maximize the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on YJ is as follows:

| Year | 2017 | 2016 | 2015 | 2014 |

|---|---|---|---|---|

| Turnover (Nm) | 28.0 | 24.0 | 19.1 | 16.8 |

| Earnings before interest and tax (EBIT) (Nm) | 9.8 | 8.5 | 7.5 | 6.8 |

| Profit after tax (PAT) (Nm) | 5.5 | 4.7 | 4.1 | 3.6 |

| Dividends (Nm) | 2.2 | 1.9 | 1.6 | 1.6 |

| Ordinary shares (Nm) | 5.5 | 5.5 | 5.5 | 5.5 |

| Reserves (Nm) | 13.7 | 10.4 | 7.6 | 5.1 |

| 8% Bonds, redeemable 2024 (Nm) | 20 | 20 | 20 | 20 |

| Share price (N) | 8.64 | 5.74 | 3.35 | 2.67 |

The par value of the shares of YJ is N1.00 per share. The general level of inflation has averaged 4% per year in the period under consideration. The bonds of YJ are currently trading at their par value of N100. The values for the business sector of YJ are as follows:

EBIT/closing total capital employed

Required:

a. Evaluate the financial performance of YJ, analyzing and discussing the extent to which the company has achieved its stated objectives of:

i. maximizing the wealth of its shareholders; and

ii. achieving continuous growth in earnings per share. (13 Marks)

Note: Up to 8 marks are available for financial analysis.

b. Analyze and discuss the relative merits of a rights issue, a placing, and an issue of bonds as ways of raising finance for the expansion. (7 Marks)

Find Related Questions by Tags, levels, etc.

What will be the balance on the share premium account after the rights issue?

| Item | N’000 |

|---|---|

| Ordinary share capital: 200,000 shares of 50k each | 100 |

| Premium account | 150 |

The company made a rights issue of 1 for 5 at N1.50, and the rights issue was fully subscribed.

A. N90,000

B. N140,000

C. N150,000

D. N190,000

E. N200,000

Find Related Questions by Tags, levels, etc.

The capital structure of Baba Oba Limited is shown below:

| Item | N’000 |

|---|---|

| Ordinary share capital: 200,000 shares of 50k each | 100 |

| Premium account | 150 |

The company made a rights issue of 1 for 5 at N1.50, and the rights issue was fully subscribed.

What is the amount of the rights issue credited to share capital?

A. N20,000

B. N40,000

C. N50,000

D. N70,000

E. N100,000

Find Related Questions by Tags, levels, etc.

A firm has recently collected the following data in respect of its capital structure, expected earnings per share, and required rate of return.

| Debt Ratio % | Expected Earnings Per Share (N) | Required Rate of Return (%) |

|---|---|---|

| 0 | 3.10 | 14 |

| 10 | 3.80 | 16 |

| 20 | 4.60 | 17 |

| 30 | 5.25 | 19 |

| 40 | 5.70 | 20 |

| 50 | 5.00 | 22 |

| 60 | 4.50 | 24 |

You are required to:

a. Compute the estimated share values. (10 Marks)

b. Determine the optimal capital structure based on the maximization of expected earnings per share and the maximization of share values. (5 Marks)

c. Which capital structure criterion would you recommend and why? (5 Marks)

(Total: 20 Marks)

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Additional Information:

Required:

a) Calculate the amount available if Crave Cottage Industry Limited is liquidated and its distribution.

(7 marks)

b) Calculate the maximum possible loss of Crave Cottage Industry Limited and its allocation to Preference Share Capital and Ordinary Share Capital. (6 marks)

c) Calculate the Bank/Cash balance of Crave Cottage Industry Limited after the reorganization. (2 marks)

d) Calculate the new stated capital for the company after the reorganization. (2 marks)

e) Prepare a Statement of Financial Position of Crave Cottage Industry Limited showing the position immediately after the scheme has been put in place.

(3 marks)

Find Related Questions by Tags, levels, etc.

c) Ten years ago, Brown Limited issued GH¢2.5 million of 6% discounted debentures at GH¢98 per 100 nominal. The debentures are redeemable in 5 years from now at GH¢2 premium over nominal value. They are currently quoted at GH¢80 per debenture ex-interest. Brown Limited pays corporate tax at the rate of 30%.

You are required to calculate the cost of debt after tax.

(4 marks)

Find Related Questions by Tags, levels, etc.

Elevate your professional expertise across key business domains with our comprehensive training programs

Follow us on our social media and get daily updates.