The Board of Directors of Danda Company Limited is proposing the purchase of either of two machines that have been proved adequate for the production of an engineering product “Gee”. The two machines are: ZIGMA 5,000 and DELPHA 7,000. Production in the first year would be affected by installation challenges and inadequate understanding of the operating instructions of the machines.

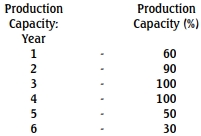

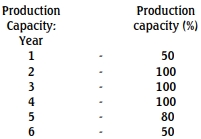

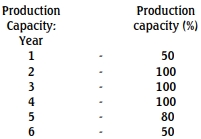

Information available from the production profile of the two machines are as shown below:

ZIGMA 5000:

Cost of machine is N16,500,000 while the life span is 6 years.

DELPHA 7000:

Cost of plant is N18,300,000 while the life span is 6 years.

Other information relevant to the company’s operations and administration are:

(i) Selling price per unit is N300.

(ii) Variable cost per unit is N150.

(iii) Annual fixed overhead exclusive of depreciation is N1,200,000.

(iv) Company depreciation policy is straight line basis.

(v) The budgeted production capacity is 100,000 units.

(vi) No opening or closing inventory is envisaged.

(vii) All sales are for cash.

(viii) All costs are for cash.

Required:

a. Prepare the SIX year profitability statement for the two machines. (6 Marks)

b. Prepare the SIX year cash flow statement for the two machines. (6 Marks)

c. What is the payback period for the two machines? (7 Marks)

d. Determine the Net Present Value (NPV) of the two machines if the acceptable discount rate for the company is 15%. (7 Marks)

e. Which of the two machines should the company acquire? (4 Marks)