- 20 Marks

AAA – Nov 2021 – L3 – Q2 – Advanced Audit Planning and Strategy

Evaluate internal and external business risks and outline pre-engagement activities for Sunsit Manufacturers Ltd.

Question

The auditors of Sunsit Manufacturers Limited had disagreements with the company on various issues. This came to a climax with the withholding of a part of the payment of the last audit fees. The auditors had also been disenchanted with the undue pressures of management and have decided that, as a result of this and the withheld fees, they would disengage from the client.

The company’s chairman, in consideration of past issues, has considered the size of the audit firm as being partly responsible for its inability to manage adequately the pressures from the company’s accounting and management team. He has subsequently approached your firm for a change, and the partners have accepted the engagement despite the predecessor auditor’s declaration of the forfeiture of the firm’s outstanding fees and no further involvement with the client and issues relating to the company.

Required:

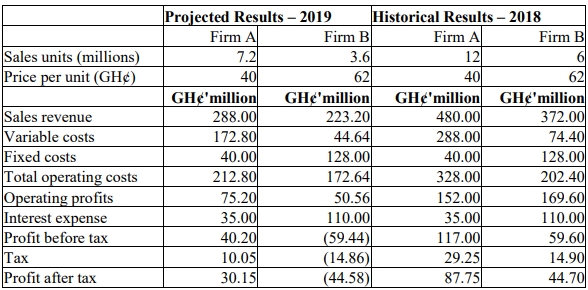

a. Following the background to the client and the engagement, evaluate the internal and external business risks that need to be considered with respect to the client. (10 Marks)

b. Discuss the pre-engagement activities to be carried on the client. (10 Marks)

Find Related Questions by Tags, levels, etc.