- 13 Marks

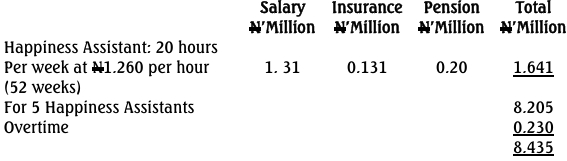

PSAF – May 2018 – L2 – Q2 – The Budgeting Process in the Public Sector

Prepare a proposed budget for Imafidon Local Government Authority Happiness and Social Centres for the year ended December 31, 2019.

Question

The Local Development Authorities (LDAs) of Imafidion Council agreed to transfer

their Social Centres for the purpose of adequate maintenance to the state

government‟s Ministry of Happiness. The state government accepted to take over

the centres and therefore requested for their 2019 budget. The following were

supplied by the Social Centres to the government through the Director of Accounts,

Ministry of Happiness.

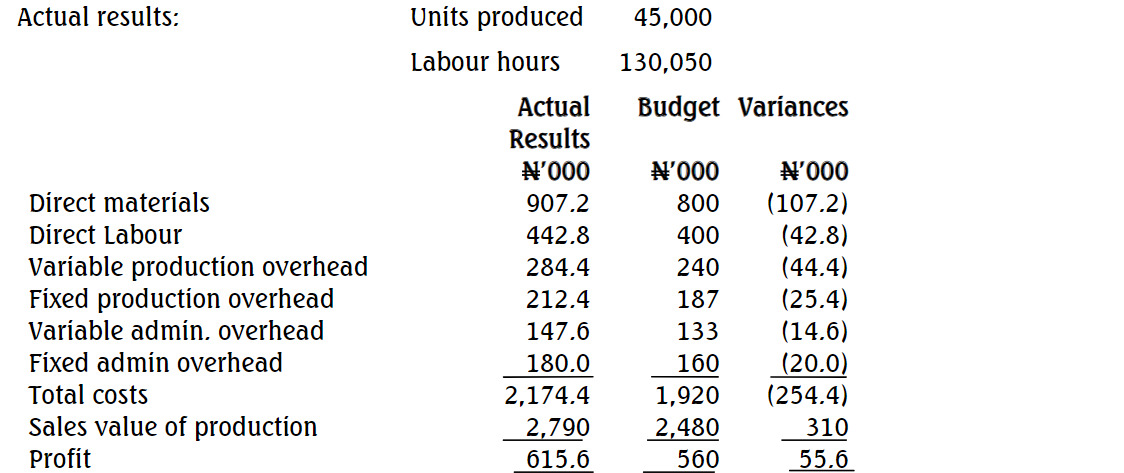

Actual salaries, wages and overhead expenses (2018)

Other details provided include:

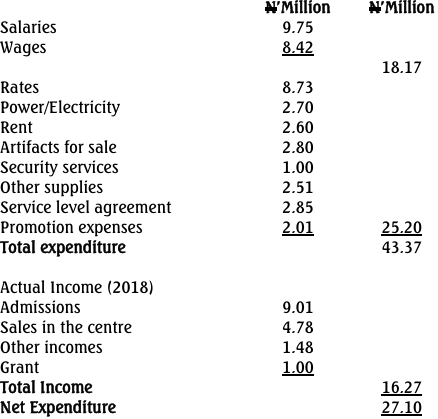

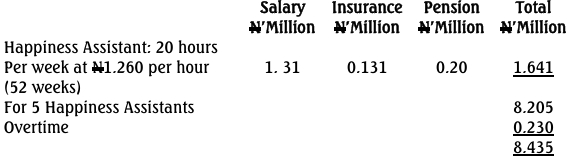

ii. The wages were for 5 employees (known as Happiness Assistants) paid on

hourly basis with maximum of 20 hours per week at N1,260 per hour, plus over

time bonus as follows:

The guideline for the budget has been given as follows:

i. Rent to remain as for last year since the lease would still be running for two

years, but security service providers would charge only N0.6m next year;

ii. No festival would be planned for the following year and as a result there

would be no promotion expenses and grant in the following year;

iii. Though same number of visitors would come to the centre, the rate of

admission fees would go up by 10 percent for the following year;

iv. There would be an increase of 5% on other incomes. The budget for Artifact

for sale would increase by the same proportion as the Sales in the Centre

budget which would increase by 20%;

v. Power/electricity and rates would increase by 8% and 2% respectively while

other supplies would increase by 2.5%;

vi. There would be 2.60% increase in wages, while the National Insurance

contributions would increase to 12% of salaries instead of the current 10%

and pension contribution would be 15% of salaries;

vii. Director of Finance, Ministry of Happiness would not be due for salary

increment but the Social Officer would earn increment of N0.088m;

viii. There would be no overtime payment; and

ix. Service level agreement was fixed at N2.948m.

You are required to prepare a proposed budget for Imafidon Local Government

Authority Happiness and Social Centres for the year ended December 31, 2019 (use

same format as in the Question). (Total 2O Marks)

Find Related Questions by Tags, levels, etc.