- 15 Marks

PM – Nov 2014 – L2 – Q5 – Cost-Volume-Profit (CVP) Analysis

Calculate break-even points for Colour-Effects Limited's products under various revenue mixes and sales scenarios.

Question

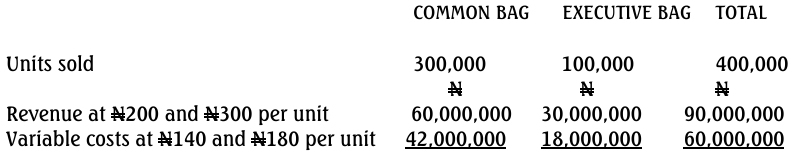

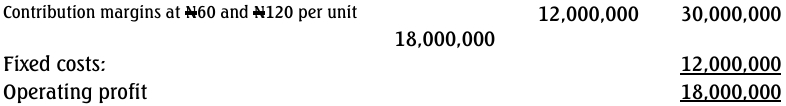

Colour-Effects Limited retails two products: Common and Executive traveling bags. The budgeted income statement for year 2015 is as follows:

Required:

(a) Calculate the break-even units, assuming that the planned revenue mix is maintained. (3 Marks)

(b) Determine the break-even point in units if only Common bags are sold and if only the Executive bags are sold. (6 Marks)

(c) Calculate the budgeted operating profit and break-even point if 200,000 units are sold, but only 20,000 are Executive bags. (6 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Break-even Analysis, Contribution margin, Operating Profit, Revenue Mix

- Level: Level 2