- 20 Marks

CR – Nov 2020 – L3 – Q2 – Earnings Per Share (IAS 33)

Calculate EPS under various scenarios for Goodwin plc and explain EPS use in investment decisions, including examples of potential ordinary shares.

Question

Goodwin plc

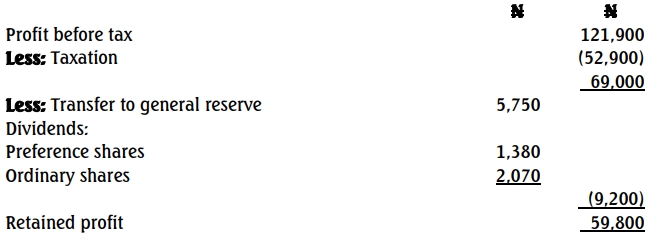

Statement of profit or loss extract for the year ended December 31, 2019

As at January 1, 2019, the issued share capital of Goodwin plc was as follows:

- 23,000 6% preference shares of N1 each

- 20,700 ordinary shares of N1 each

Required: Calculate the basic and diluted earnings per share for the year ended December 31, 2019 under the following circumstances:

a. Where there is no change in the issued share capital. (5 Marks)

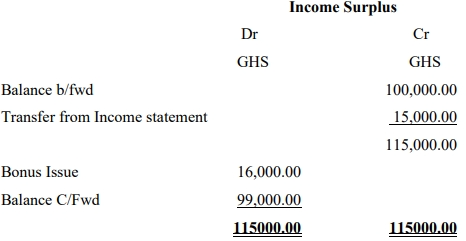

b. The company made a bonus issue of one ordinary share for every four shares in issue at September 30, 2019. (3 Marks)

c. The company made a rights issue of shares on October 1, 2019 in the proportion of 1 for every 5 shares held at a price of N1.20. The middle market price for the shares on the last day of quotation cum rights was N1.80 per share. (8 Marks)

d. Briefly discuss how investors use the EPS ratio in investment decisions and give TWO examples of potential ordinary shares under IAS 33. (4 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Basic EPS, Bonus issue, Diluted EPS, EPS, IAS 33, Investment decisions, Rights Issue

- Level: Level 3

- Topic: Earnings Per Share (IAS 33)