Waste Management in Ghana

Ghana has been battling with domestic and industrial waste for many years and successive governments made it one of the topmost priorities to address the menace. However, all the well-intended measures adopted in the past have not yielded significant result in addressing the waste menace. The current government which assumed office in January 2017 created a new ministry, Ministry of Sanitation and Water Resources, in a bid to give new impetus to the waste management agenda. Two years on, the general public verdict is that much has not changed as heaps of waste can be seen in every nook and cranny of the major cities in the country. The President has the vision to make Accra, the nation’s capital city, the cleanest within the sub-region but the vision is deemed to be far from realisation. It is estimated that Ghana generates 1.7 million tonnes of waste per year and Accra alone generates 3000 tonnes of waste per day.

It also appears that the state has lost the battle on the desecration of the country’s major beaches with litter and open defecation in abundance. The other national monuments such as colonial forts and castles along the coastal belts have not been spared. These areas are major tourist attraction centers and the negative financial consequences cannot be overemphasized. A popular river, River Odorna, which runs through the national capital has been silted with plastic and organic waste, displacing the water which runs through it and terminate in South Atlantic Ocean. The nation has not recovered from the twin disaster of flood and fire which claimed over 100 lives when River Odorna was overflooded. This resulted in nearby petrol filling station being flooded and with oil displaced fire from unknown source that triggered massive fire killing all the people who had taken refuge there.

The current national policy on waste management is based on decentralisation to the various Metropolitan, Municipal and District Assemblies (MMDAs) who are the sub-national organs responsible for administration of various urban, peri-urban and towns in the country. The MMDAs manage waste within their jurisdiction by signing contracts with various privately-owned waste management companies and to some limited extent MMDAs-owned trucks which has proven to be less effective with frequent break downs of those trucks. The waste so collected is disposed at various landfill sites constructed by the MMDAs but most of those sites are now full and are turning into mountains of waste. The hosting communities of landfill sites are up in arms for their closure as health and environmental negative impact takes a heavy toll on the residents. There is currently pending a plethora of law suits by affected residents to get the courts to force MMDAs to shut down the landfill sites.

The citizens engage in indiscriminate disposal of waste everywhere in the country. The culverts, drainage systems and streets are suffocating under the pressure of waste especially that of plastic. Rubbish are thrown onto the streets from moving commercial and private vehicles alike. At various lorry stations where dustbins are provided, drivers’ mates dispose waste to the floor where cars are parked. Citizens build up wastes in front of their houses day time and by the following morning those waste have vanished. It has been established that a number of residents are beginning to dispose waste into gutters and shoulders of major roads at night. Although, all MMDAs have punitive fines and sanctions in their bye-laws nobody seems to suffer any consequences engaging in littering.

Waste Management Sector

The waste management sector has a number of actors including a few large companies with large concessions and a lot of trucks for waste collection and disposal, MMDAs with their internal waste collection units, small companies with few trucks and hence limited concessions, and recently individuals with tricycles, without concessions, have emerged to cater for unserved new residential areas springing up at the outskirts of the cities. The large companies have a fleet of garbage trucks with capacity to collect huge tonnes of waste within their concession areas. Thus, the large companies are better resourced and able to do mass collection of waste. Many small companies with few garbage trucks are actively involved in waste management effort and are generally granted concession over smaller areas. Despite the collective effort by large and small companies as well as MMDAs, large amount of waste remains uncollected and in fact the amount of waste generated is on the rise. This situation has led to individuals using tricycles to collect waste from households for a fee.

The waste management companies get paid in two ways – directly by households and companies that have been provided waste bins and containers and indirectly by MMDAs for the picking of waste containers provided at vantage points for use by market centres, lorry stations and households that may not subscribe to direct service. Payments to waste companies are persistently in several months of arears with serious implications on their financial positions. This situation has resulted in irregular collection of pool waste containers with attendant consequence of mounting waste in urban centres.

The Group and Company

One of the major large companies operating in the waste sector is Waste Tiger Ltd and is part of Omega Group Ltd (OGL) of Companies. The other subsidiaries under OGL include Sewerage Systems and Medical Waste Treatment Ltd, GCD Diamond Ltd, JB Plant Pool Ltd, ACB Bank Ltd and Recycling & Compost Plant. A brief description of the business of each of the subsidiaries follows:

Waste Tiger Ltd (WTL) – is involved in collection of solid domestic and commercial waste in various MMDAs across the country.

Sewerage Systems and Medical Waste Treatment Ltd (SSMWT) – handle liquid and medical related waste across the major cities.

GCD Diamond Ltd (GDL) – a mining company involved in extraction and processing of raw diamond which was added to the group 4 years ago.

JB Plant Pool Ltd (JPPL) – leading supplier of heavy duty and earth moving plant and equipment, buses and renders total service support for all products sold in case of faults or breakdowns.

ACB Bank Ltd (ABL) – is an indigenous financial institution providing retail, corporate and treasury services to diverse clients.

Recycling & Compost Plant (RCP) Ltd – is involve in recycling of waste, export of waste and production of fertilizer for local market.

The Group CEO, Mr. Joseph Quainoo is not enthused at the rising cost of the group and its subsidiaries due to duplication of functional areas within each subsidiary. He wants to reconfigure the existing organisational structure in which there will be dual line of reporting and responsibilities. The CEO wants a structure that combines functional specialisms (marketing, finance, Human resource and Information technology) and the subsidiaries and by so doing eliminates subsidiary-specific functional areas. Again, the structure should result in keeping subsidiaries largely independent but with necessary intervention with respect to functional activities.

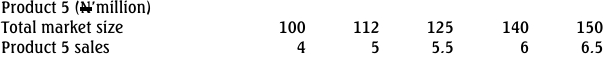

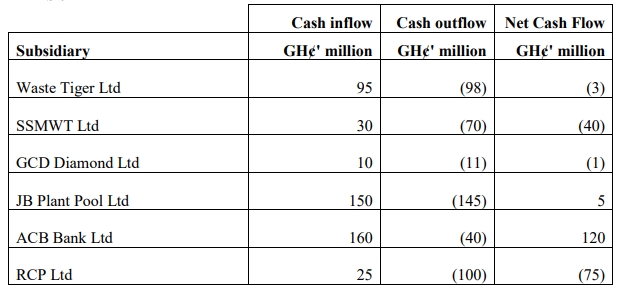

The Group CEO wants to do performance analysis of the various subsidiaries based on the extent of cash generated and used by respective subsidiaries. The group Chief Finance Officer (CFO) was tasked and has generated a summary of cash inflows and cash outflows for each subsidiary. The cash flow information is summarised in Exhibit 1 below:

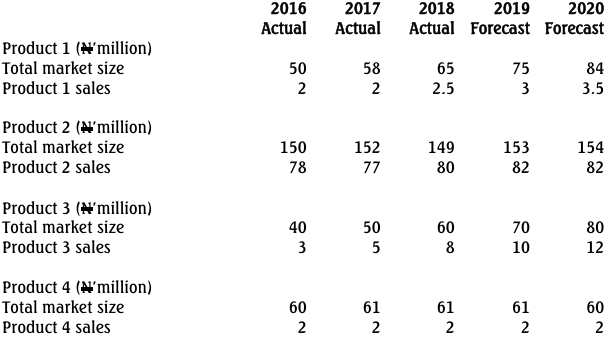

The Group CEO wants a portfolio matrix constructed to analyse the various subsidiaries and advice on strategic option to pursue for each subsidiary so as to inform resource allocation within the group.

Recycling & Compost Plant (RCP) Ltd

RCP Ltd is the latest subsidiary incorporated and commenced business/operations in January 2018. The idea to start RCP Ltd followed from a waste management conference Mr. Joseph Quainoo attended in China and his encounter with the CEO, Chun Juan, of the largest waste management company in China. At the said private meeting Chun shared the idea of how lucrative recycling of waste is becoming, the fact that China is importing waste and how fertilizer is being produced from waste. Armed with this information and the absence of waste recycling in Ghana, Mr. Quainoo decided to venture into that segment of waste management.

RCP Ltd has three major lines of business – production of organic fertilizer from organic waste, plastic from plastic waste to be sold to plastic processing companies and finally process some organic and plastic waste for export to China. The establishment of RCP Ltd is the first significant intervention to change traditional use of landfill sites in waste management to waste recycling which is more sustainable and also generate economic activities. Although, various governments have always proposed to set up a recycling plant but that never materialised. Perhaps, the inertia and apparent lack of commitment by governments to build recycling plant is because it is capital intensive. The company has a combined permanent and contract workforce of 570 and as business picks up, more hands would be engaged. Kindly refer to exhibit 2 for the data that was used in performing investment appraisal. The current capacity of the company only allows it to process 30% of total waste generated in the capital city. The vision of Mr. Quainoo to is to expand to all the major cities in the country.

Exhibit 2

The plant and equipment and all related cost necessary to make it operational has been pegged at GH¢1,500,000. This recycling plant has an expected life of five years, after which it would have to be replaced and will have no residual value at the end of this period. The plant can produce and process a maximum of 75,000 tonnes of waste per year over five years. The revenue per processed ton is GH¢110. To ensure that the maximum output is achieved, the company will spend GH¢250,000 a year in maintaining the plant over the next five years.

Based on the maximum output of 75,000 tonnes per year, the following expected costs per ton excluding the maintenance costs above are: waste and treatment material GH¢32.5, labour GH¢27.5 and overhead cost GH¢42.5. The following information is also relevant:

The waste and treatment materials figure above include a charge of GH¢10 for treatment (chemicals) materials that is currently being stocked by one of the subsidiaries in the group and can be used for waste treatment. Each ton of waste requires 1,000 liters of the chemicals and the charge is based on the original cost of GH¢5 per 500 liters for the chemicals. It is a material that is currently used in one of the other subsidiary and the cost of replacing the chemical is GH¢7.50 per 500 liters. The chemical could easily be sold at a price of GH¢6.25 per 500 liters.

The labour cost relate to payments made to employees that are directly involved in recycling the waste materials. The labour cost include some employees who have no work at present and if there were no production, they will be made redundant immediately at a cost of GH¢1,150,000. However, if production takes place, the employees are likely to find another work at the end of the five-year period and so no redundancy costs will be incurred.

The overhead cost includes a depreciation charge for the new machinery and equipment. The policy of the business is to depreciate non-current assets in equal instalments over their expected life. All other overheads included in the above figure are incurred in recycling.

The company uses a cost of capital of 20% to assess projects. The management of the company is interested in determining the net present value of the recycling plant and equipment at the end of the five-year period.

Required: a) Assess the legal, economic and social factors in the environment of the waste management sector in Ghana. (6 marks)

b) Recommend appropriate organisational design that will help the group coordinate and control activities among the subsidiaries. Your recommendations should include THREE (3) benefits and THREE (3) demerits associated with that design. Support your answer with appropriate diagram. (10 marks)

c) Using an appropriate portfolio matrix, explain the various categories of businesses within the Omega Group Ltd and advise the CEO of appropriate portfolio strategy (or strategies) to adopt for each subsidiary. Justify your choice of a particular portfolio matrix and categorization of the subsidiaries based on your selected matrix. (8 marks)

d) Using information provided on recycling plant and equipment, determine the net present value of the project after five years. (12 marks)

e) Recommend FOUR (4) practical and tangible measures government can adopt to deal with the waste menace in the country. (4 marks)