- 15 Marks

CR – Nov 2018 – L3 – Q3 – Business valuations

Identify valuation factors, determine share value using the net assets approach, and prepare the consolidated financial statement for GCC Bank Ltd after the takeover of Wunam Bank Ltd.

Question

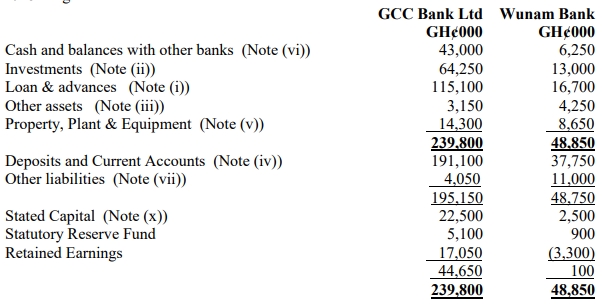

The shareholders of Wunam Bank (Ghana) Limited have decided to sell the company to GCC Bank (Ghana) Limited following their inability to recapitalize the company as demanded by the Bank of Ghana. The statement of financial positions of the two banks as at 31 March 2018 are given below.

Additional Information:

- Wunam Bank Ltd carries a huge non-performing loan portfolio. It is estimated that only 40% of the outstanding loans are recoverable.

- Investments represent 91-Day Treasury Bills held as secondary reserves. An audit has shown that the investments were overstated in 2017, as interest on investments for that year amounts to GH¢4.15 million.

- Other assets include long outstanding debits amounting to GH¢3.6 million, which are not represented by tangible assets.

- Deposits amounting to GH¢3.75 million could not be accounted for. This phenomenon has prevailed since 2014 but has not been provided for in the accounts.

- Property, Plant & Equipment includes an old banking software amounting to GH¢1.25 million, considered worthless. The remaining tangible fixed assets have been revalued at GH¢15.3 million.

- Cash and balances with other banks include GH¢2.4 million due from Sakara Rural Bank Ltd, which was liquidated in 2016.

- Other liabilities include interest earned on investments amounting to GH¢3.15 million.

- Goodwill was assessed at 2.5% of adjusted deposits and current accounts.

- Wunam Bank Ltd has invested in Government bonds worth GH¢12.6 million as at 31 March 2018 to fund new ATMs and branches.

Required: a) Identify FOUR (4) factors you would consider in determining the value to be placed on assets when using the net assets approach to valuation of Wunam Bank Ltd.

(4 marks)

b) Determine the value to be placed on the shares of Wunam Bank Ltd using the net assets approach to valuation.

(5 marks)

c) Prepare the statement of financial position of GCC Bank Ltd after the takeover using your answer in (b). Assume the following:

- The purchase consideration was duly settled.

- GCC Bank Ltd took over all assets and liabilities.

- Goodwill was written off.

Find Related Questions by Tags, levels, etc.

- Tags: Bank Valuation, Consolidation, Financial Reporting, Takeover, Valuation

- Level: Level 3

- Topic: Business valuations

- Series: NOV 2018