- 1 Marks

AAA – Nov 2013 – L3 – AII – Q6 – Public Sector Audits

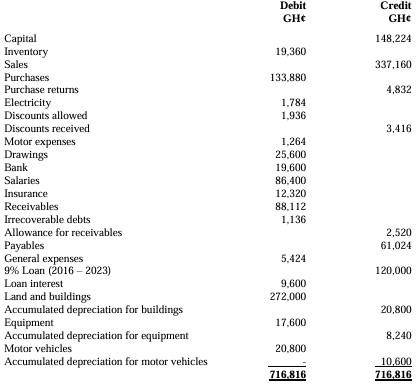

Explores the alternate terminology for balance sheets of parastatals.

Find Related Questions by Tags, levels, etc.

- Tags: Audit Standards, Balance Sheet, Financial Statements, Public Sector, Terminology

- Level: Level 3

- Topic: Public sector audit

- Series: NOV 2013