- 40 Marks

FM – May 2021 – L3 – Q1 – Business Valuation Techniques

Evaluate the value of Zinco Limited using various valuation techniques and estimate the coupon rate for bond financing.

Question

Palemo Temidayo (PT) is a large engineering company listed on the stock market. The company is considering the purchase of Zinco, an unlisted company that produces a number of engineering components.

The board of directors is concerned about the appropriate price to pay for Zinco. As a starting point, it has been decided to provide a range of valuations based on different industry-recognized techniques.

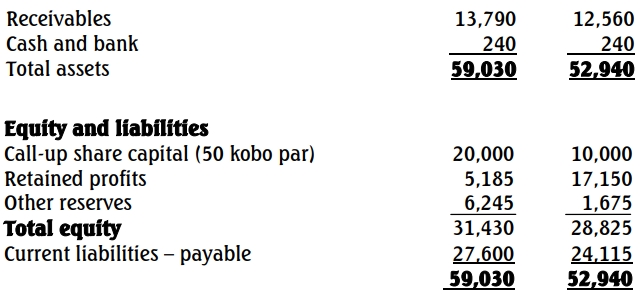

Summarized financial statements of Zinco Limited for the last two years are shown below:

Statements of Profit or Loss for the years ended 30 June

| 2020 (N’000) | 2019 (N’000) | |

|---|---|---|

| Sales Revenue | 112,400 | 101,090 |

| Opening Profit before exceptional items | 6,510 | 4,100 |

| Exceptional Items | (10,025) | – |

| Interest Paid (Net) | (1,400) | (890) |

| Profit/(Loss) before Tax | (4,915) | 3,210 |

| Taxation | (1,050) | (890) |

| Profit/(Loss) after Tax | (5,965) | 2,320 |

| Note: Dividend | 1,000 | 500 |

Statement of Financial Position as at 31 March (N’000)

Additional Information Relating to Zinco:

- If the acquisition succeeds, there will be revenue synergy leading to an increase in annual sales revenue of Zinco of 25% for three years, and 10% per year thereafter.

- Non-cash expenses, including depreciation, were N4,100,000 in 2020.

- Income tax rate is 30% p.a.

- Capital expenditure was N5 million in 2020 and is expected to grow at approximately the same rate as revenue.

- Working capital, interest payments, and non-cash expenses are expected to increase at the same rate as revenue.

- Zinco has a patent with a current market value of N50 million. This has not been included in the non-current assets.

- Operating profit is expected to be approximately 8% of revenue in 2021 and to remain at the same percentage in future years.

- Dividends are expected to grow at the same rate as revenue.

- The realizable value of inventory is expected to be 70% of its book value.

- The estimated cost of equity is 12%.

- The average P/E ratio of listed companies of similar size to Zinco is 30:1.

- Average earnings growth in the industry is 6% per year.

Required:

a. Prepare a report that gives an estimate of Zinco using:

(i) Asset-based valuation (8 Marks)

(ii) P/E ratios (6 Marks)

(iii) Dividend-based valuation (6 Marks)

(iv) The present value of expected future cash flows (5 Marks)

(v) Discuss the potential accuracy of each of the methods used and recommend, with reasons, a value or range of values that PT might bid for Zinco. State clearly any assumptions that you make.

b. The directors of PT are considering issuing some ₦100 nominal value ten-year bonds to finance the purchase of Zinco. To make the bonds look attractive to potential investors, the bonds are to be issued at a discount of 10%. Based on PT’s credit rating, investors are expected to require a return of 7% per year from such bonds.

You are required:

To estimate the coupon rate that PT will have to pay on these bonds in order to satisfy the investors. (5 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Asset-Based Valuation, Bond pricing, Discounted Cash Flow, Dividend valuation, P/E Ratio

- Level: Level 3