Question Tag: Analysis

- 1 Marks

MI – Nov 2022 – L1 – SA – Q19 – Statistical Analysis and Machine Learning Technologies

Identification of key elements in legally acceptable digital evidence presentation

Find Related Questions by Tags, levels, etc.

- Tags: Analysis, Digital Evidence, Legal Presentation

- Level: Level 1

- Topic: Statistical Analysis and Machine Learning Technologies

- Series: NOV 2022

- 40 Marks

FR – Mar/Jul 2020 – L2 – Q1 – Financial Statement Analysis of Dangoyaro Plc

Preparation and analysis of financial statements, cash flow, and equity statements of Dangoyaro Plc for the year ended September 30, 2019, using IAS standards.

Question

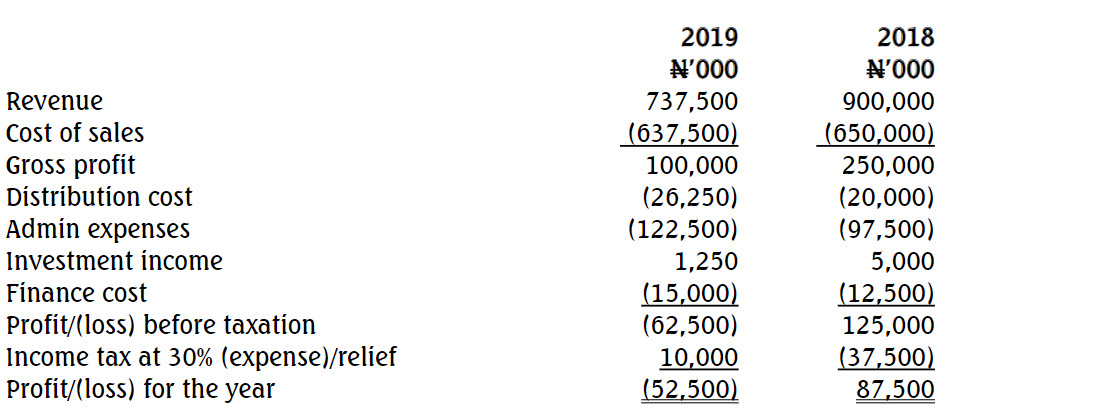

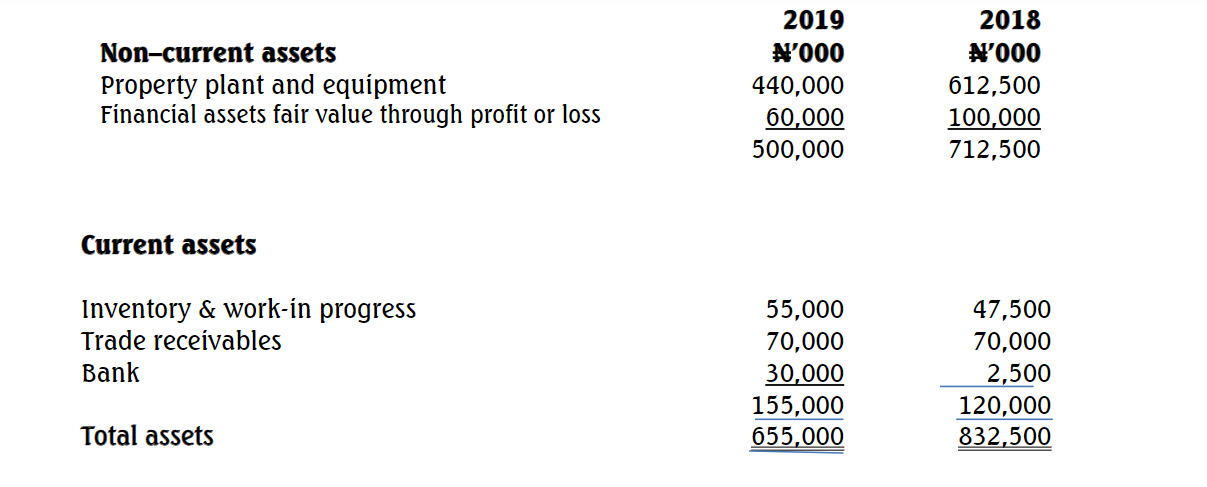

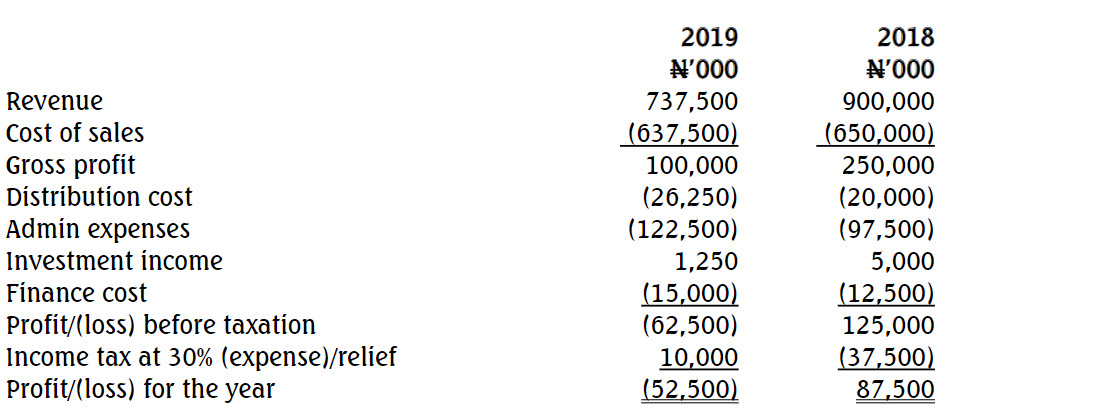

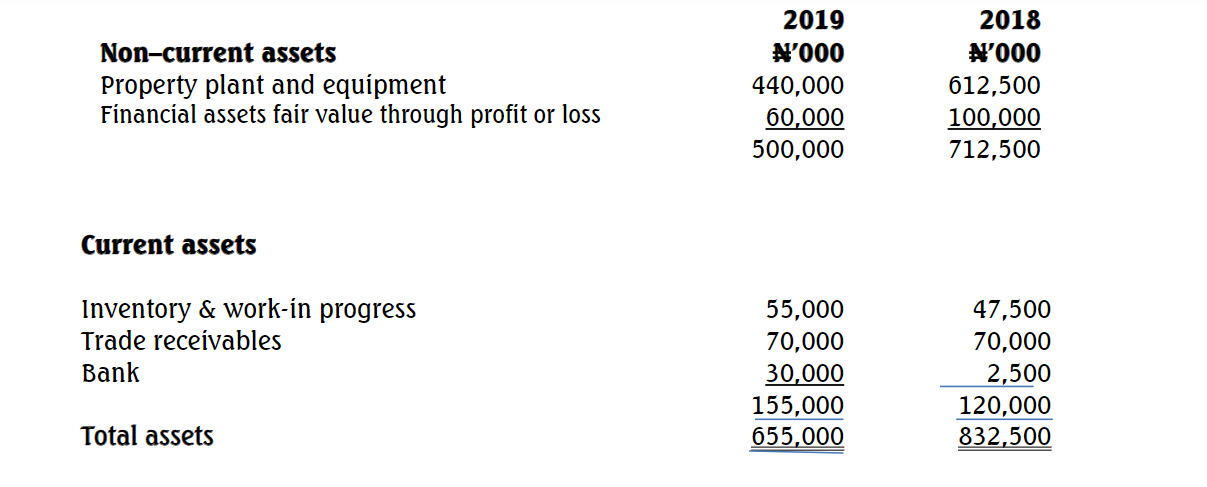

Dangoyaro Plc is a manufacturing company, and the summarized financial statements for the year ended September 30, 2019, and the comparative figures for 2018 are as follows:

Statement of Financial Position as at September 30

Equity and liabilities

Equity

The following information was obtained from the chairman’s statement in the annual report presented at the Annual General Meeting (AGM) held on December 22, 2019, and in the notes to the financial statements.

(i) Market condition during the year ended September 30, 2019, proved very challenging due largely to difficulties in the global economy as a result of the recession, which led to a decline in the share price and property values.

(ii) Dangoyaro Plc has not been immune from these effects and our properties have suffered impairment losses of ₦125 million in the year. The excess of these losses over previous surpluses has led to a charge to cost of sales of ₦37.5 million in addition to the normal depreciation charge.

(iii) There is no addition to or disposal of non-current assets during the year.

(iv) In response to the downturn, the company has made a number of employees redundant, incurring severance costs of ₦32.5 million (included in cost of sales), undertaken cost savings in advertising and other administrative expenses.

(v) The difficulty in the credit market has meant that the finance cost of our fixed interest bank loan has increased from ₦12.5 million to ₦15 million. In order to improve cash flows, the company made a rights issue during the year and reduced the dividend per share by 50%.

(vi) Despite the above events and the associated costs, the board of directors of Dangoyaro Plc believes the company’s performance has been quite resilient in these difficult times.

You are required to prepare:

a. An adjusted statement of profit or loss for the year ended September 30, 2019 (without taking into consideration information in the chairman’s statement and notes to the financial statements). (5 Marks)

b. Statement of changes in equity for the year ended September 30, 2019. (8 Marks)

c. Statement of cash flows for the year ended September 30, 2019, using the indirect method in accordance with provisions of IAS 7. (12 Marks)

d. Analyse and discuss the financial performance and position of Dangoyaro Plc as shown by the above financial statements as at September 30, 2019, using the following financial ratios:

i. Gross profit margin

ii. Net profit margin

iii. Return on capital employed (CE = ordinary shares plus reserves)

iv. Asset turnover

v. Current ratio

vi. Quick ratio

vii. Gearing ratio

viii. Receivables period

ix. Inventory period

x. Payables period

(15 Marks)

(Total 40 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Analysis, Cash Flow, Financial Statements, Ratios, Statement of Changes in Equity

- Level: Level 2

- 15 Marks

CR – Nov 2018 – L3 – Q4 – Consolidated Financial Statements

Calculate key financial ratios for TGG and analyze its financial performance and cash flow based on the data provided for the year ended 30 September 2018.

Question

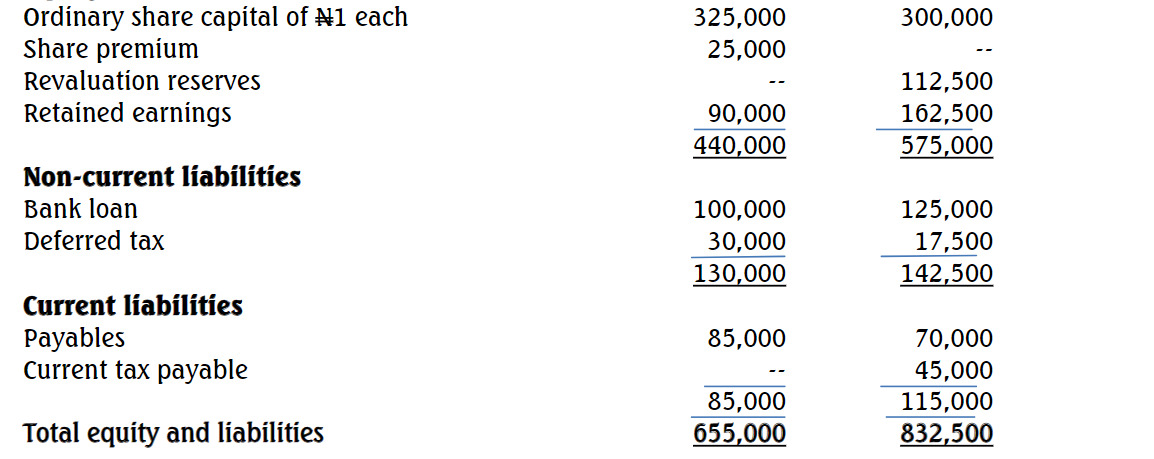

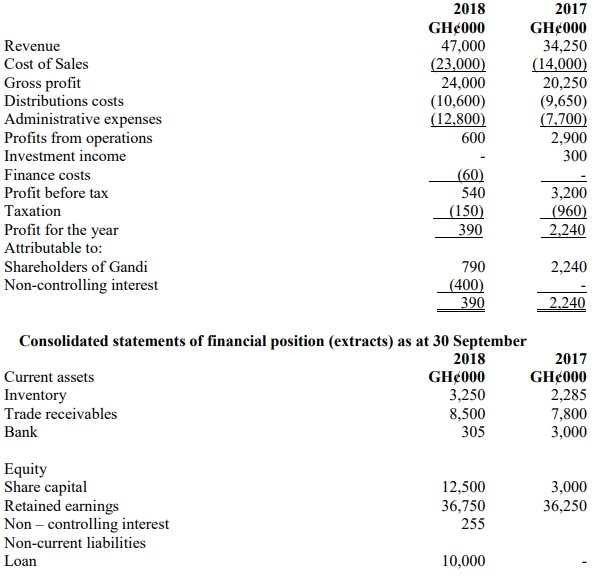

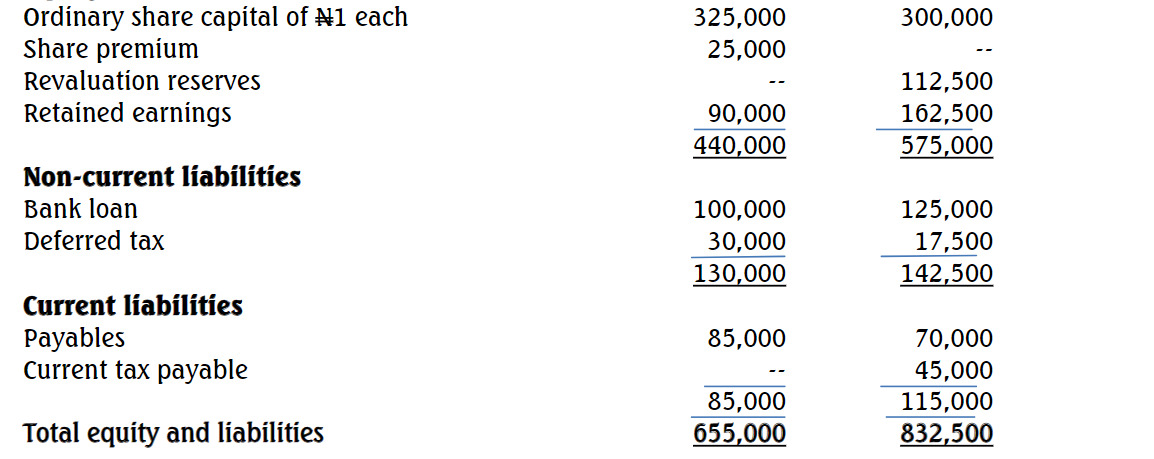

The Gandi Group (TGG) operates in the farming industry and has operated a number of 100% owned subsidiaries for many years. The Gandi group has its operations in the Brong-Ahafo Region of Ghana. Its financial statements for the last two years are shown below.

Additional Information:

- TGG has become increasingly worried about two major areas in its business environment: reliance on large supermarkets (which demand long payment terms), and the increase in fuel prices, which raises the cost of distribution.

- To address these concerns, TGG purchased 80% of Asida Ltd on 1 October 2017. This was TGG’s first acquisition of a subsidiary without owning 100% of it. Asida Ltd operates two luxury hotels in the Ashanti Region.

- TGG raised finance by disposing of GH¢5.5 million in investments (with a GH¢2.25 million gain on disposal, included in administrative expenses) and by taking a GH¢10 million loan.

- Asida Ltd opened a third hotel in Accra in March 2018. Initial reviews were poor, but feedback improved after the appointment of a new marketing director in May 2018.

- Ratios for the year ended 30 September 2017:

- Gross profit margin: 59.1%

- Operating margin: 8.5%

- Return on capital employed: 7.4%

- Inventory turnover period: 60 days

- Receivables collection period: 83 days

Required: a) Prepare the equivalent ratios for the year ended 30 September 2018.

(5 marks)

b) Analyze the financial performance and cash flow of TGG for the year ended 30 September 2018, making specific reference to any concerns or expectations regarding future periods.

(10 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Analysis, Cash Flow, Consolidation, Financial Ratios, Performance

- Level: Level 3

- Topic: Consolidated Financial Statements

- Series: NOV 2018

- 1 Marks

MI – Nov 2022 – L1 – SA – Q19 – Statistical Analysis and Machine Learning Technologies

Identification of key elements in legally acceptable digital evidence presentation

Find Related Questions by Tags, levels, etc.

- Tags: Analysis, Digital Evidence, Legal Presentation

- Level: Level 1

- Topic: Statistical Analysis and Machine Learning Technologies

- Series: NOV 2022

- 40 Marks

FR – Mar/Jul 2020 – L2 – Q1 – Financial Statement Analysis of Dangoyaro Plc

Preparation and analysis of financial statements, cash flow, and equity statements of Dangoyaro Plc for the year ended September 30, 2019, using IAS standards.

Question

Dangoyaro Plc is a manufacturing company, and the summarized financial statements for the year ended September 30, 2019, and the comparative figures for 2018 are as follows:

Statement of Financial Position as at September 30

Equity and liabilities

Equity

The following information was obtained from the chairman’s statement in the annual report presented at the Annual General Meeting (AGM) held on December 22, 2019, and in the notes to the financial statements.

(i) Market condition during the year ended September 30, 2019, proved very challenging due largely to difficulties in the global economy as a result of the recession, which led to a decline in the share price and property values.

(ii) Dangoyaro Plc has not been immune from these effects and our properties have suffered impairment losses of ₦125 million in the year. The excess of these losses over previous surpluses has led to a charge to cost of sales of ₦37.5 million in addition to the normal depreciation charge.

(iii) There is no addition to or disposal of non-current assets during the year.

(iv) In response to the downturn, the company has made a number of employees redundant, incurring severance costs of ₦32.5 million (included in cost of sales), undertaken cost savings in advertising and other administrative expenses.

(v) The difficulty in the credit market has meant that the finance cost of our fixed interest bank loan has increased from ₦12.5 million to ₦15 million. In order to improve cash flows, the company made a rights issue during the year and reduced the dividend per share by 50%.

(vi) Despite the above events and the associated costs, the board of directors of Dangoyaro Plc believes the company’s performance has been quite resilient in these difficult times.

You are required to prepare:

a. An adjusted statement of profit or loss for the year ended September 30, 2019 (without taking into consideration information in the chairman’s statement and notes to the financial statements). (5 Marks)

b. Statement of changes in equity for the year ended September 30, 2019. (8 Marks)

c. Statement of cash flows for the year ended September 30, 2019, using the indirect method in accordance with provisions of IAS 7. (12 Marks)

d. Analyse and discuss the financial performance and position of Dangoyaro Plc as shown by the above financial statements as at September 30, 2019, using the following financial ratios:

i. Gross profit margin

ii. Net profit margin

iii. Return on capital employed (CE = ordinary shares plus reserves)

iv. Asset turnover

v. Current ratio

vi. Quick ratio

vii. Gearing ratio

viii. Receivables period

ix. Inventory period

x. Payables period

(15 Marks)

(Total 40 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Analysis, Cash Flow, Financial Statements, Ratios, Statement of Changes in Equity

- Level: Level 2

- 15 Marks

CR – Nov 2018 – L3 – Q4 – Consolidated Financial Statements

Calculate key financial ratios for TGG and analyze its financial performance and cash flow based on the data provided for the year ended 30 September 2018.

Question

The Gandi Group (TGG) operates in the farming industry and has operated a number of 100% owned subsidiaries for many years. The Gandi group has its operations in the Brong-Ahafo Region of Ghana. Its financial statements for the last two years are shown below.

Additional Information:

- TGG has become increasingly worried about two major areas in its business environment: reliance on large supermarkets (which demand long payment terms), and the increase in fuel prices, which raises the cost of distribution.

- To address these concerns, TGG purchased 80% of Asida Ltd on 1 October 2017. This was TGG’s first acquisition of a subsidiary without owning 100% of it. Asida Ltd operates two luxury hotels in the Ashanti Region.

- TGG raised finance by disposing of GH¢5.5 million in investments (with a GH¢2.25 million gain on disposal, included in administrative expenses) and by taking a GH¢10 million loan.

- Asida Ltd opened a third hotel in Accra in March 2018. Initial reviews were poor, but feedback improved after the appointment of a new marketing director in May 2018.

- Ratios for the year ended 30 September 2017:

- Gross profit margin: 59.1%

- Operating margin: 8.5%

- Return on capital employed: 7.4%

- Inventory turnover period: 60 days

- Receivables collection period: 83 days

Required: a) Prepare the equivalent ratios for the year ended 30 September 2018.

(5 marks)

b) Analyze the financial performance and cash flow of TGG for the year ended 30 September 2018, making specific reference to any concerns or expectations regarding future periods.

(10 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Analysis, Cash Flow, Consolidation, Financial Ratios, Performance

- Level: Level 3

- Topic: Consolidated Financial Statements

- Series: NOV 2018