- 20 Marks

FR – Nov 2023 – L2 – Q2 – Business Combinations (IFRS 3)

Analyze Oyowood Limited's financials and adjust ratios based on acquisition considerations.

Question

Chisom Plc experienced rapid growth in recent years through the acquisition and integration of other companies. Chisom Plc is interested in acquiring Oyowood Limited, a retailing company, which is one of several companies owned and managed by the same family.

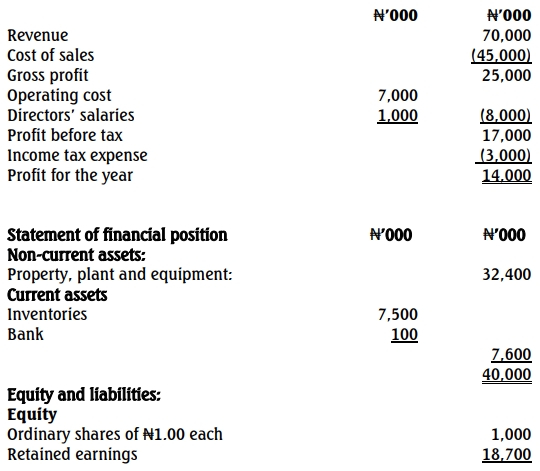

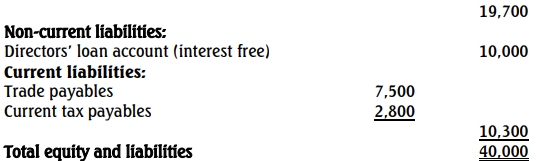

The summarized financial statements of Oyowood Limited for the year ended December 31, 2022, are as follows:

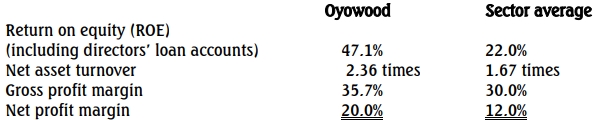

From the above financial statements, Chisom Plc has calculated for Oyowood Limited the ratios below for the year ended December 31, 2022. It has also obtained the equivalent ratios for the retail sector average, which can be taken to represent Oyowood‟s sector.

Additional Information:

- Oyowood Limited buys all inventories from family companies at a 10% discount below market prices.

- Post-acquisition, Chisom Plc would replace the board of directors with a new board at a remuneration cost of ₦2.5 million per annum.

- Directors’ loan accounts will be refinanced through a 10% interest-bearing commercial loan of the same amount.

- The purchase price for Oyowood Limited is expected to be ₦30 million.

Required:

a. As the financial analyst for Chisom Plc, recalculate the ratios for Oyowood Limited after adjustments based on points (i) to (iv) above. (10 Marks)

b. Draft a memo to the managing director of Chisom Plc commenting on the adjusted performance of Oyowood Limited. (10 Marks)

Find Related Questions by Tags, levels, etc.