- 20 Marks

FM – May 2019 – L3 – Q4 – Portfolio Management

Evaluate abnormal returns for shares and bonds, calculate required returns for a pension fund portfolio, and assess its active management strategy.

Question

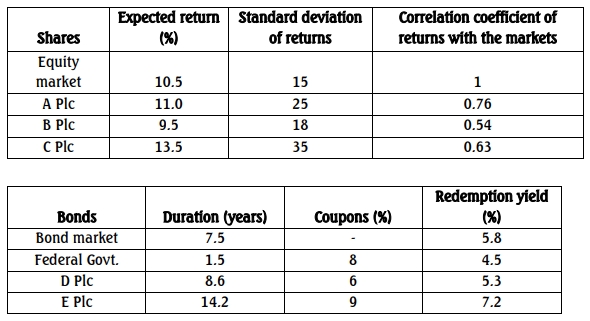

The managers of a pension fund follow an active portfolio management strategy. They try to purchase shares and bonds that show a positive abnormal return (positive alpha factor in the case of shares). The pension fund is required by law to hold at least 40% of its investments in bonds. N100million is currently available for

investment. Three shares and three bonds are being considered for purchase. The required return on bonds may be measured using a model similar to the capital asset pricing model, where beta is replaced by the relative duration of the individual bond (Di) and the bond market portfolio (Dm) i.e. Di/Dm.

Note: Assume the risk-free rate is 4 percent per year.

Required:

a. Evaluate whether or not any of the shares or bonds is expected to offer a positive abnormal return. (10 Marks)

b. The pension fund currently has the maximum permitted investment in shares and wishes to continue this strategy. It has a market value of N1,000 million and a beta of 0.62.

Required:

Calculate the required return from the pension fund if any shares and bonds with positive abnormal returns are purchased. State clearly any assumptions that you make. (4 Marks)

c. Discuss possible problems with the pension fund’s investment strategy. (6 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Abnormal Returns, CAPM, Investment strategy, Portfolio Management

- Level: Level 3

- Topic: Portfolio Management