- 20 Marks

CR – Nov 2018 – L3 – SB – Q4 – Statement of Cash Flows (IAS 7)

Preparation of Happy Plc’s statement of cash flows and analysis of revaluation and financing adjustments.

Question

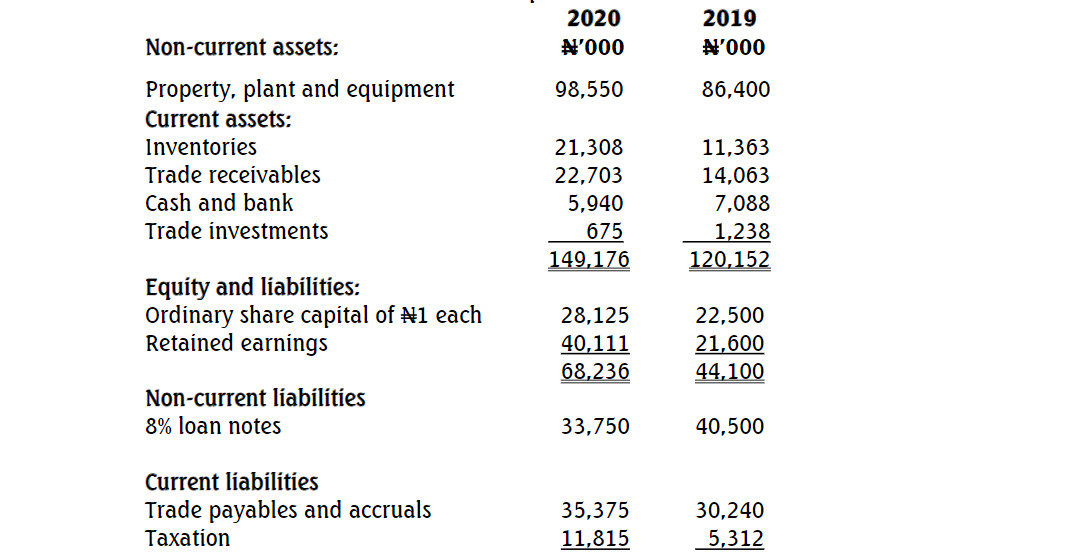

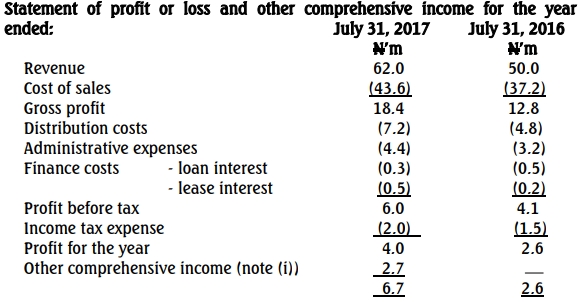

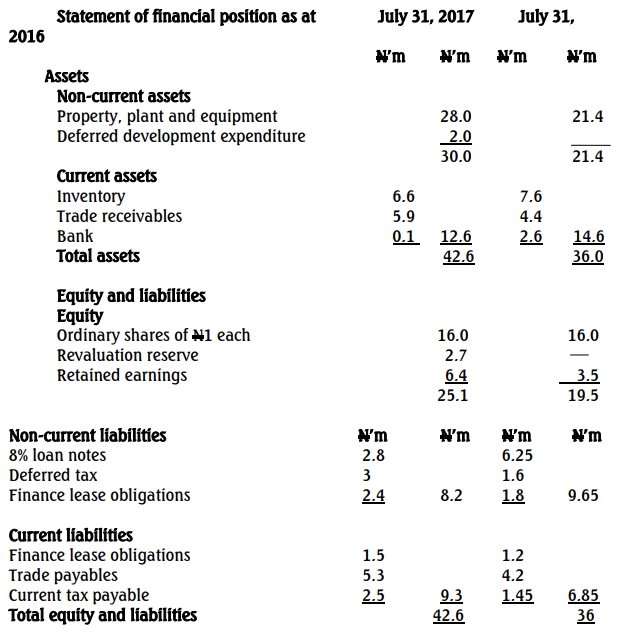

Happy is a publicly listed company. Its financial statements for the year ended July 31, 2017, including comparatives, are shown below:

Notes:

- On November 1, 2016, Happy acquired an additional plant under a finance lease with a fair value of ₦3 million. The property was also revalued upward by ₦4 million, with ₦1.3 million of the revaluation reserve transferred to deferred tax. No disposals occurred during the period.

- Depreciation on property, plant, and equipment amounted to ₦1.8 million, and amortization of deferred development expenditure was ₦0.4 million.

Required:

Prepare the statement of cash flows of Happy Plc for the year ended July 31, 2017, in accordance with IAS 7, using the indirect method. (20 Marks)

Find Related Questions by Tags, levels, etc.

Report an error